Some people keep different wallets for different parts of their life. One for daily expenses, one for travel, and one for emergency savings. In the online world, a Virtual Visa Card feels like that extra wallet, a small, separate space where your money stays safe while you shop, subscribe, or explore new digital platforms. You don’t carry it in your pocket, but it’s always ready inside your device, waiting to help you pay without exposing your main bank card.

Many people search “What is a Visa Virtual Card” because they want a simple explanation, something they can understand quickly without technical jargon. This guide makes everything clear, from how it works to why more people choose it today.

What Exactly Is a Virtual Visa Card?

A Virtual Visa Card is a digital version of a Visa card. You receive the card number, expiry date, and CVV, but you never receive any physical plastic. You load money into it and use it for online payments just like a normal Visa card. It works across global websites, apps, and subscription platforms, where visa card is accepted.

It keeps your main bank account hidden and gives you a clean, separate place for online spending. This makes the Virtual Visa Card a popular choice for people who value safety, privacy, and control.

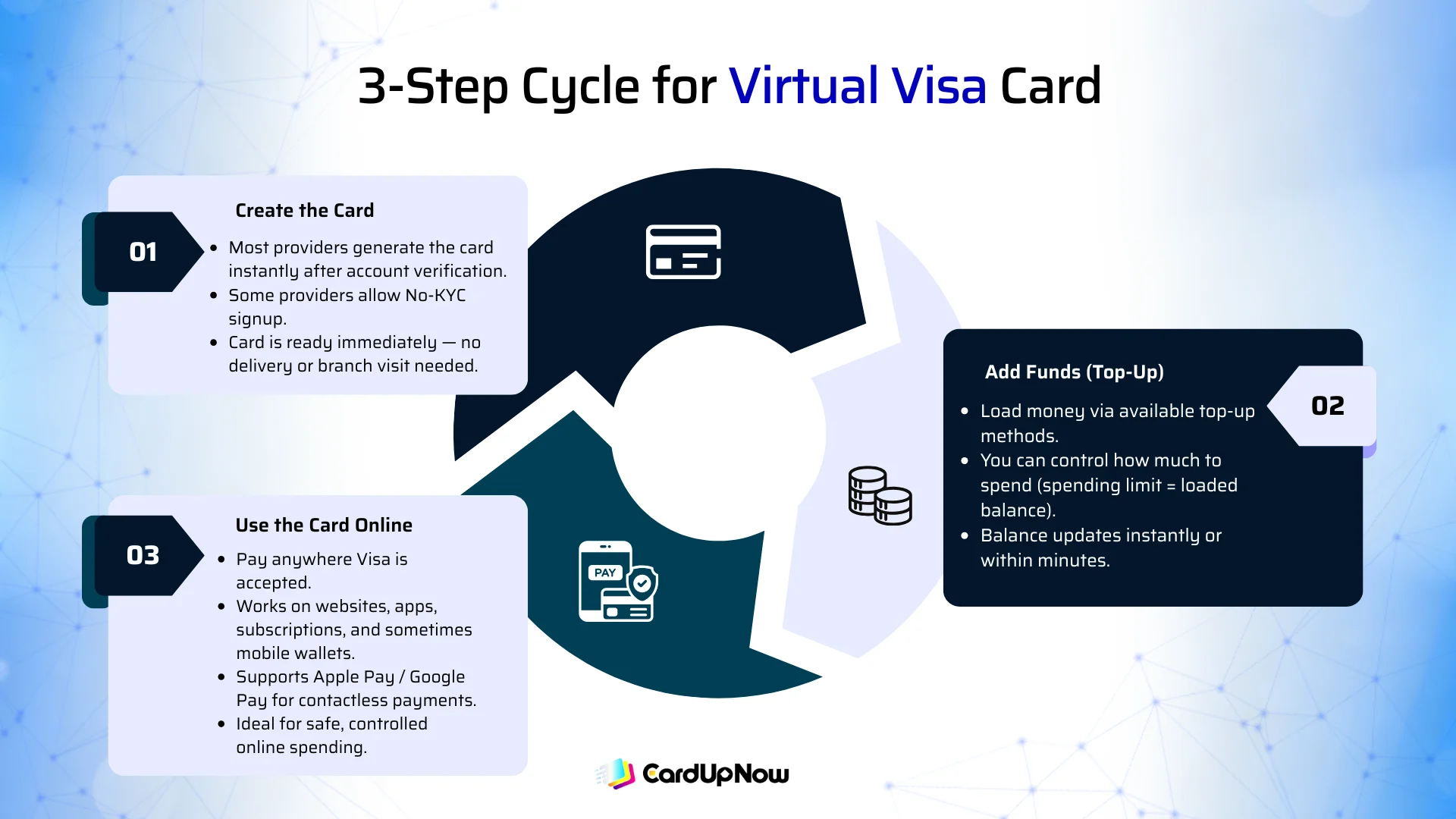

How Does a Virtual Visa Card Work?

A Virtual Visa Card works through a simple three-step cycle: create the card, add funds, and use it online. Most providers generate the card instantly after you verify your account. There are also some providers who let you get your card without any kyc. You load money through the available top-up options, and once your balance is ready, you can pay online wherever Visa is accepted.

Some platforms also support mobile wallets. When a provider allows Apple Pay or Google Pay integration, your virtual card can even work for contactless payments. But the core purpose remains the same: secure, controlled online spending.

Why People Prefer Using a Virtual Visa Card

One of the biggest reasons for the rise of the virtual card visa is safety. Your real bank card stays untouched. If a website seems new or risky, you can still pay confidently because only your prepaid balance is exposed.

Another reason is control. A Virtual Visa Card makes it easier to manage how much you spend online. You add what you want to use, and that is the limit. This helps with staying within budgets, keeping entertainment and subscription costs separate, and avoiding unexpected charges.

Users also love the convenience. You don’t wait for delivery. You don’t need a branch visit. You create it, fund it, and start using it instantl, perfect for digital users, students, freelancers, and anyone who buys from international websites.

Disposable Virtual Visa Card: When You Need Extra Privacy

Some providers offer a Disposable Virtual Visa Card. This is a special version designed for single-use or short-term transactions. After you use it, the card becomes invalid automatically.

It is very helpful for:

- Trial subscriptions that may auto-renew

- One-time purchases on new websites

- Protecting your identity on lesser-known platforms

This extra layer of safety is one of the strongest advantages of virtual cards.

Situations Where a Virtual Visa Card Might Not Work

Even though a Virtual Visa Card works across most online platforms, it has limitations. Some hotels and airlines place temporary holds that prepaid cards may not support. Certain merchants require address verification, and if the details do not match, the payment might fail. In-store purchases may also be limited unless the card is added to a supported mobile wallet.

These limitations are normal, but knowing them beforehand saves you from confusion when a payment doesn’t go through.

Fees and Costs You Should Know about Virtual Visa Card

Each provider sets its own fee structure. Some charge for top-ups, foreign currency transactions, or inactivity. Many users overlook these small details and end up confused later. It is always better to choose a provider that explains fees clearly before you use the card.

How to Get Your Virtual Visa Card

Most providers follow a simple setup process. You create your account, verify your identity, and receive your Virtual Visa Card instantly. After loading funds, the card becomes ready for online payments.

Good platforms make the dashboard easy to navigate. You can view your card, check your balance, track transactions, freeze or unfreeze the card, and manage everything from one place. This is helpful for beginners who want a smooth digital experience without complicated steps.

Common Problems and How to Solve Them Easily

A few issues can happen with any virtual card, but most solutions are simple. If a payment fails, check your balance, update your billing information, or retry the transaction. For subscription issues, adding a bit more balance usually solves the problem. Refunds may take a few business days because merchants process them at different speeds.

These situations are common across all virtual card providers, not just one platform.

Final Thoughts

A Virtual Visa Card gives you safety, control, and freedom in the online world. It is simple, fast, and smart for anyone who pays digitally. From subscriptions and entertainment to global online shopping, it helps you manage your spending without risking your main bank account.

If you want better privacy, smoother international payments, or a secure way to manage online purchases, a Virtual Visa Card is a modern solution that fits today’s digital lifestyle.

FAQs about what is a visa virtual card

What is a Virtual Visa Card used for?

It is used for secure online payments, subscriptions, digital services, and international transactions without exposing your main card.

Can I use a Virtual Visa Card for recurring payments?

Yes. Most platforms accept it for monthly and yearly subscriptions as long as your balance is sufficient.

Does a Virtual Visa Card work in physical stores?

It can work if the provider supports linking the card to Apple Pay or Google Pay. Without wallet support, it usually works online only.

Are Virtual Visa Cards safe to use?

Yes. They are safer because they are prepaid. Only the loaded amount is at risk, not your entire bank account.

Can I receive refunds on a Virtual Visa Card?

Yes. Refunds return to the same card balance. Processing time depends on the merchant, usually a few business days.