Most people first hear about a virtual Visa card when they’re trying to pay for something online and their regular bank card keeps declining. Others discover it while looking for a safer way to handle subscriptions or to pay on websites they don’t fully trust. No matter how you come across it, a virtual Visa card quickly becomes one of those tools you wonder how you lived without.

But there’s still one big question people ask all the time: “Where can I actually use a virtual Visa card?”

Okay, now this is the guide that gives you clear answers where to use virtual visa card and the situations where you need to be careful, and the cases where a virtual card isn’t the best option. And because this blog is written for CardUpNow users, you’ll also learn how to make the most out of the platform’s features like instant card creation, crypto top-ups, multiple cards, and the Elite upgrade.

What a Virtual Visa Card Really Lets You Do

A virtual Visa card works like a normal Visa card, just without the plastic. You get a card number, expiry date, and CVV instantly, and you can use it on almost any website that accepts Visa. For many people, this solves issues like card blocks, privacy concerns, budgeting, or the need to separate different types of spending.

But the real magic lies in choosing the right places to use it. Below is a clear breakdown that goes beyond the generic answers competitors give.

Where Virtual Visa Cards Work Best

Virtual Visa cards perform best across a wide range of online platforms and services, making them a convenient choice for everyday digital payments. Here are the places where they work especially well.

Online Shopping on Global Marketplaces

If you shop on websites like Amazon, AliExpress, eBay, Shein, or Temu, a virtual Visa card works just like your regular card. These platforms accept virtual numbers without any trouble.

Many shoppers prefer using a virtual card here because it keeps their main bank card safe from fraud and accidental charges.

Subscriptions and Streaming Platforms

Virtual cards shine when it comes to managing recurring payments. You can use them on places like Netflix, Spotify, Canva, ChatGPT, LinkedIn Premium, and hundreds of SaaS tools.

CardUpNow users often create a separate card for each subscription, so they can freeze a card instantly if they want to cancel without hunting for hidden settings.

Online Ads and Digital Marketing Platforms

Google Ads and Meta Ads sometimes decline regular debit cards or block banks they consider “risky.” A funded virtual Visa card solves this.

Agencies and freelancers use CardUpNow to create multiple cards, one per client or campaign, so billing stays clean and easy to track.

International Payments

A virtual Visa card helps you pay global merchants without worrying about your local bank declining the transaction. This is especially helpful for freelancers, travelers, and people who pay for international software or tools.

With CardUpNow, adding funds through crypto gives you even more flexibility if your local bank has restrictions.

Online Travel Bookings (Flights & Hotels You Pay Online)

If you’re booking flights or prepaid hotel reservations online, virtual cards generally work smoothly. They help avoid your bank flagging a foreign travel website as suspicious.

Just note: if a hotel requires a physical card at check-in, use the virtual card only to reserve, not to pay at the property.

Where Virtual Visa Cards Work With Some Caution

While virtual Visa cards are widely accepted, there are a few situations where extra care is needed. Below are the places where they usually work, but with certain conditions to keep in mind.

Hotels That Verify Cards at Check-In

Many hotels allow you to reserve using a virtual card, but physical verification at check-in is common. If they ask to see the same card you booked with, a virtual card won’t work.

So the rule is simple: prepaid bookings are fine; pay-at-property bookings need a physical card.

Car Rentals and In-Person Travel Services

Car rental companies almost always require a physical card for security deposits. Virtual Visa cards may not be accepted because they can’t place a hold with ID verification.

Use your virtual card for the booking fee but expect to use a physical card for the deposit.

Some Marketplaces With Extra Fraud Checks

Platforms like Airbnb, Etsy (for sellers), or some gaming platforms occasionally perform additional checks. In most cases, virtual Visa cards work, but if the platform requires physical verification or a 3D-Secure check your bank doesn’t support, a transaction may fail.

Where Virtual Visa Cards Don’t Work Well

ATMs or Cash Withdrawals

A virtual Visa card is not built for ATM cashouts. It has no physical form and cannot be inserted or tapped at cash machines.

Physical Stores Without Digital Wallets

Many people ask: “Can you use a virtual Visa card in store?”

The answer: only if the store accepts Apple Pay or Google Pay and you’ve added your virtual card to the wallet.

If the store only accepts physical swipe/chip cards, a virtual card won’t work.

Services That Require a Physical Card for Proof

Some government services, offline merchants, and local businesses require an in-person card presentation. Virtual cards won’t be accepted here.

Why CardUpNow Works Better Than Standard Virtual Cards

CardUpNow is built to give users more control, more flexibility, and fewer payment issues than a typical virtual card service. You can create a Virtual Visa card within seconds, and in many cases you don’t need to go through long verification steps, which is extremely helpful when you need to make an urgent payment.

Another major advantage is the ability to top up using crypto. This gives users in strict banking regions or international markets a simple way to fund their cards without dealing with blocked transactions or slow bank transfers.

CardUpNow also lets you create multiple virtual cards for different needs. You can keep separate cards for subscriptions, online shopping, client payments, marketing campaigns, and travel bookings. Each card has its own spending limits, freeze option, and activity record, making it easier to stay organized and avoid surprises.

For users who spend more or run bigger operations, CardUp Elite adds even more power. It offers higher limits, stronger stability, and a smoother experience for things like advertising, team spending, or frequent global payments.

With these features working together, CardUpNow makes virtual card usage faster, safer, and far more flexible for everyday users and businesses alike.

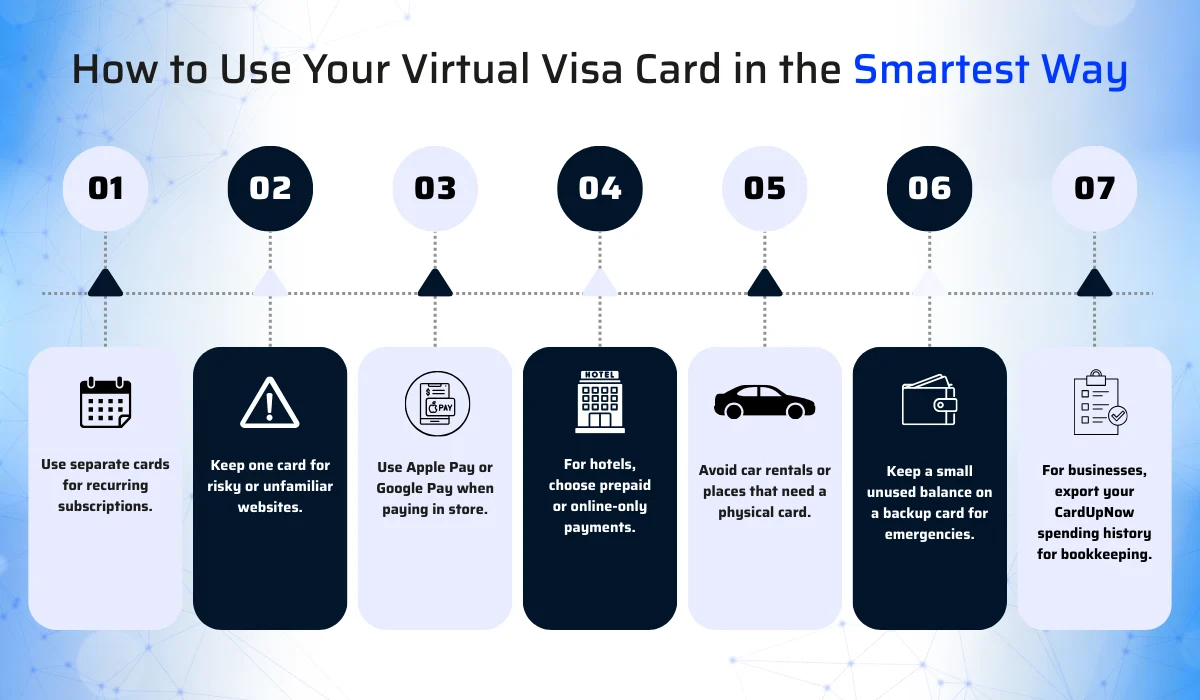

How to Use Your Virtual Visa Card in the Smartest Way

A few simple habits make your virtual card experience smooth:

- Use separate cards for recurring subscriptions.

- Keep one card for risky or unfamiliar websites.

- Use Apple Pay or Google Pay when paying in store.

- For hotels, choose prepaid or online-only payments.

- Avoid car rentals or places that need a physical card.

- Keep a small unused balance on a backup card for emergencies.

- For businesses, export your CardUpNow spending history for bookkeeping.

These small steps improve virtual card acceptance and keep your payments flexible.

Virtual Visa Cards Open More Doors Than You Think

A virtual Visa card is one of the easiest ways to shop online safely, manage subscriptions, keep ads running, and pay international merchants without stress. When you use CardUpNow, you get even more freedom – instant cards, crypto top-ups, and multiple cards for different purposes.

So if you’ve ever wondered where to use a virtual Visa card, the answer is simple: almost everywhere online, many places in-store through Apple/Google Pay, and with a bit of caution on travel and in-person services.

And once you try it, you’ll probably use it more than your physical card.