A lot of people today want an easy way to shop online without using a bank card. This is where the Visa Virtual Reward Card becomes helpful.

Think of it like this. You buy something online, the payment page asks for card details, and you already have a ready digital card sitting in your inbox. No waiting for delivery, no long setup, and no stress. A Visa Virtual Reward Card makes online payments feel simple and smooth, even for someone who is not used to using cards. It gives you quick access to secure spending on the internet, which is why so many people have started using it for everyday purchases.

What Is a Visa Virtual Reward Card

A Visa Virtual Reward Card is a prepaid Visa card that comes in digital form. You receive the card details by email. It includes the card number, CVV, and expiry date. You can use it on any online store that accepts Visa payments.

You do not need a physical card. You do not need bank details. You get the card instantly, load money on it, and start using it.

How the Visa Virtual Reward Card Works

The card works like any other Visa card used for online payments. The only difference is that everything is digital. Once you receive the email with your card details, you can copy the information and use it for online shopping, bill payments, or subscription services.

You also have full control over your spending because the balance is fixed. You can only use the amount loaded on the card. This makes it safe for budgeting and everyday purchases.

Why People Prefer Visa Virtual Reward Cards

A Visa Virtual Reward Card has become very popular because it solves many user problems. Here are some clear reasons people love it.

Instant Delivery

You do not have to wait for a physical card. You receive your card by email within minutes. This is helpful for quick shopping or urgent payments.

Secure for Online Use

You do not share your bank details. You only use the virtual card information. This lowers the risk of fraud and keeps your main accounts safe.

Works on Most Online Stores

You can use it on popular platforms like Amazon, Alibaba, AliExpress, and many other international websites that accept Visa.

Great for People Who Travel or Live Abroad

Since the card is digital, you can use it from anywhere in the world. It supports online payments for global services and international purchases.

No Bank Account Needed

Many people want to shop online but do not have a card from a local bank. A Visa Virtual Reward Card solves this problem. You only buy the card and start using it.

Easy for Budget Control

You cannot overspend because the card is prepaid. You only use what is inside the balance. This makes it perfect for small purchases or safe spending.

Where You Can Use a Visa Virtual Reward Card

A Visa Virtual Reward Card works on almost any website that supports Visa prepaid payments. Since the card arrives instantly in digital form, you can use it just like any other virtual debit card for fast and secure online spending. Here are some of the most common places where users enjoy smooth online Visa payment with this card.

Online Shopping with a Virtual Prepaid Card

You can use the card on global e-commerce sites for fashion, gadgets, accessories, and daily items. Many users rely on it for international stores because it works without bank verification and keeps online shopping simple.

Subscriptions and Digital Services Using a Virtual Card

The card is useful for streaming platforms, software subscriptions, hosting plans, domain purchases, learning tools, and other digital services. Since the card is prepaid, it gives safe control over payments in a clean and easy way.

Travel and Booking Platforms with Online Visa Payment

Many travel websites support Visa prepaid cards. You can use it for hotel bookings, flight platforms, car rentals, or travel services that accept Visa. It helps travelers avoid issues with local bank cards when paying on foreign sites.

Digital Goods and Instant Virtual Card Usage

Gamers and digital shoppers can use the card for apps, game top-ups, online gift cards, digital tools, and many platforms that support Visa payments. It gives you a quick way to pay for digital items without linking a bank account.

Who Benefits the Most From a Visa Virtual Reward Card

Many people find the Visa Virtual Reward Card helpful for daily online use. Students enjoy it because they can buy things online without handling traditional bank cards. Freelancers use it often since they need access to international tools, subscriptions, and platforms, and this card makes those payments simple. Travelers also rely on it because it allows them to shop on foreign websites without facing banking or card compatibility issues. Even regular online shoppers prefer it, as it gives them a safe, fast, and stress-free way to pay on almost any online store.

Steps to Use a Visa Virtual Reward Card

Using the card is easy. Here is a simple step by step process.

- Buy the card from a trusted provider.

- Check your email for the card details.

- Go to your preferred online store.

- Choose Visa as the payment option.

- Enter your card number, CVV, and expiry date.

- Confirm the payment.

If the website accepts Visa prepaid cards, your payment will be successful.

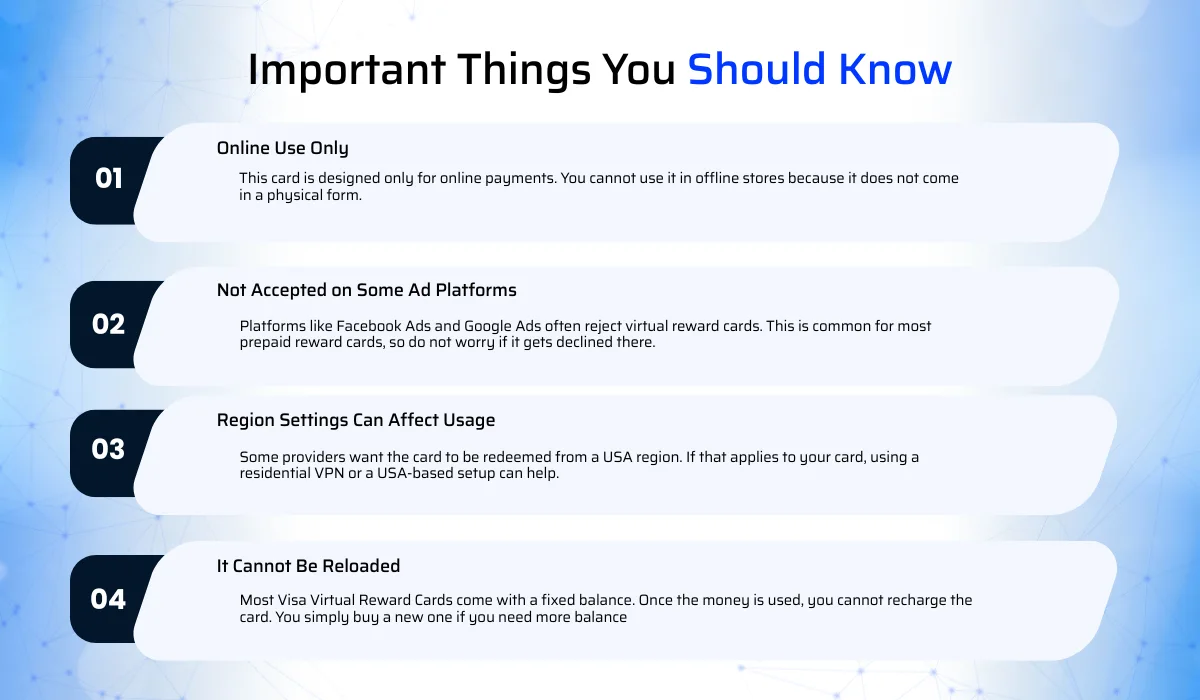

Important Things You Should Know

There are a few simple points that help you use a Visa Virtual Reward Card without any trouble.

- Online Use Only : This card is designed only for online payments. You cannot use it in offline stores because it does not come in a physical form.

- Not Accepted on Some Ad Platforms : Platforms like Facebook Ads and Google Ads often reject virtual reward cards. This is common for most prepaid reward cards, so do not worry if it gets declined there.

- Region Settings Can Affect Usage : Some providers want the card to be redeemed from a USA region. If that applies to your card, using a residential VPN or a USA-based setup can help.

- It Cannot Be Reloaded : Most Visa Virtual Reward Cards come with a fixed balance. Once the money is used, you cannot recharge the card. You simply buy a new one if you need more balance.

Why Many People Switch to Visa Virtual Reward Cards

People like the card because it is simple and predictable. There is no waiting time. No paperwork. No need for a bank account. You get fast access to global payments in a safe and controlled way.

It has become a popular solution for online buyers, young adults, remote workers, and global shoppers.

Ready to Get Your Own Virtual Visa Reward Card?

If you want a smooth and fast way to pay online, CardUpNow gives you instant access to virtual cards that work on top global platforms. You can buy a Virtual Visa Card in seconds and start using it right away. No bank account. No KYC. Just simple and secure online spending from anywhere you are.

Try CardUpNow and enjoy the freedom of quick digital payments today.

FAQ

How do I activate my Visa Virtual Reward Card after purchase?

Most cards activate automatically as soon as you receive the email. You simply open the mail, check the card details, and start using it for online payments.

Can I use a Visa Virtual Reward Card for international websites?

Yes. These cards support global online payments and work on most international stores that accept Visa prepaid cards.

What should I do if a website declines my Virtual Visa Reward Card?

Some platforms do not support prepaid or reward cards. If you face a decline, try another site that accepts Visa prepaid cards or check if the platform requires region-based verification.

Is it safe to use a Visa Virtual Reward Card for online shopping?

Yes. It adds an extra layer of safety since it is not linked to any bank account. You only spend the loaded balance, which keeps your financial information protected.

How long does the balance stay valid in a Virtual Visa Reward Card?

Most cards stay active for around 12 months from the issue date. You can check the exact expiry date in the email you receive with the card details.