Digital payments have changed the way people shop, subscribe, and manage money. Today many apps and platforms want to offer their users a faster, safer, and more flexible payment option. This is why the Visa Virtual Card API has become a popular tool across the world. It helps businesses create and manage virtual cards directly inside their own system, without long steps or manual work.

What a Virtual Card API Really Means

A Virtual Card API is a digital system that lets a business issue virtual cards through software. Instead of creating each card manually, a company can connect this API to their platform and generate cards automatically whenever a user needs one. It works in the background. The user only sees the result and the platform sees full control.

With this API, a business can create virtual cards, set limits, check transactions, pause cards, remove cards, and manage the entire card system from their own dashboard or app. This makes the experience smooth for both the company and the user.

Because the cards are digital, there is no physical delivery. This saves time and gives instant access to global online payments.

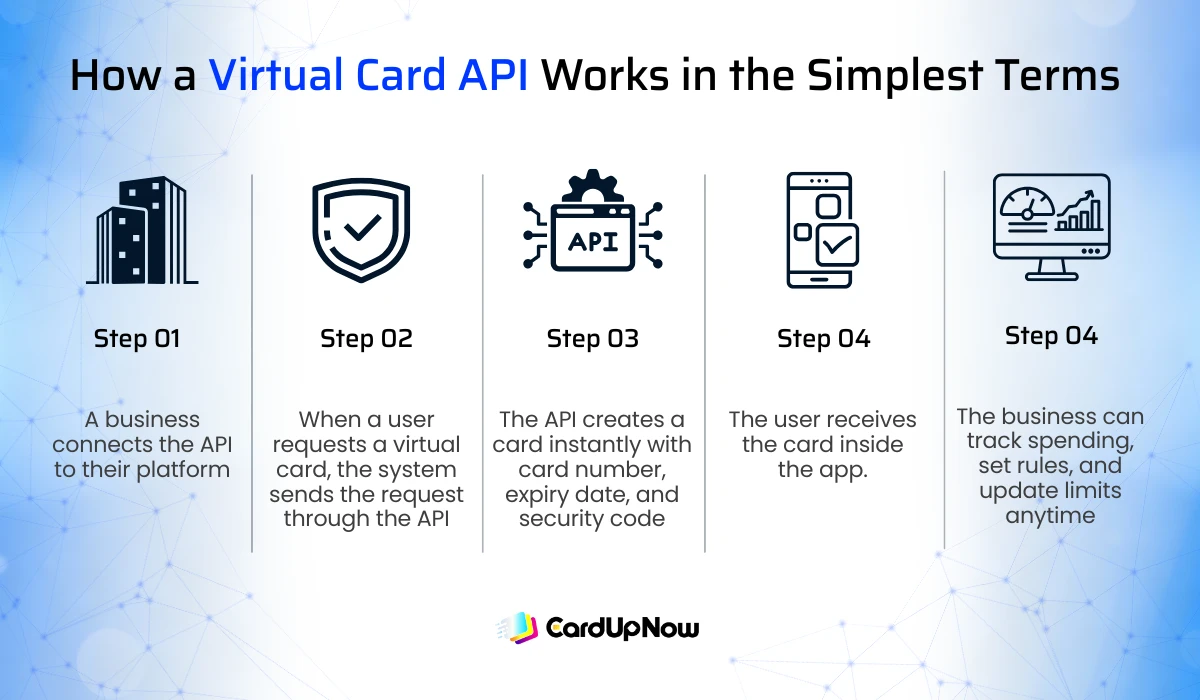

How a Virtual Card API Works in the Simplest Terms

To understand the flow, imagine the app or platform as the “front desk” and the API as the “back system” that does the real work.

Here is the easy journey:

- A business connects the API to their platform.

- When a user requests a virtual card, the system sends the request through the API.

- The API creates a card instantly with card number, expiry date, and security code.

- The user receives the card inside the app.

- The business can track spending, set rules, and update limits anytime.

Everything happens digitally. Everything happens within a few seconds. This simple structure is why companies trust this technology. It is fast, safe, and fully under their control.

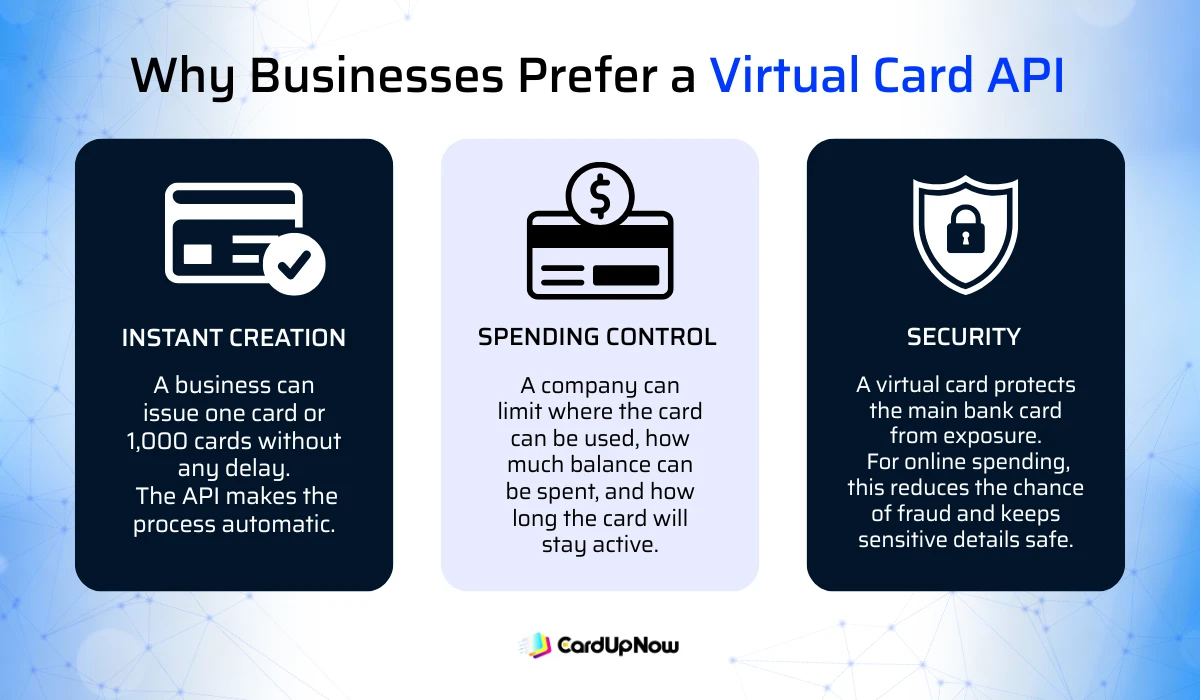

Why Businesses Prefer a Virtual Card API

The demand for virtual cards is growing every year. People want flexible online payments, and companies want a system that supports global users. A Virtual Card API brings strong value because it solves many common problems businesses face in digital transactions.

One of the biggest advantages is instant creation. A business can issue one card or a thousand cards without any delay. The API makes the process automatic. This reduces work for the team and improves satisfaction for the user.

Another major benefit is spending control. A company can limit where the card can be used, how much balance can be spent, and how long the card will stay active. If there is a risk or suspicious activity, the card can be paused instantly. This level of control is useful for finance teams, ecommerce platforms, freelancer networks, and businesses that manage many transactions daily.

Security is another key reason. A virtual card protects the main bank card from exposure. For online spending, this reduces the chance of fraud and keeps sensitive details safe.

Because everything is tracked in real time, accounting becomes easier. Businesses can monitor all expenses and avoid errors in manual reporting. This helps companies stay organized and reduces financial stress.

Who Uses a Visa Virtual Card API and Why It Helps Them

Many industries use this system because it supports a wide range of daily tasks. Fintech apps use it to offer digital cards to their customers. Freelancer marketplaces issue cards so freelancers can spend their earnings instantly. Corporate expense platforms use virtual cards to help teams manage travel, work tools, and office purchases.

Subscription platforms benefit because they can manage recurring payments with controlled cards. Ecommerce platforms use virtual cards for vendor payouts, refunds, and secure transactions. Digital banks use them to give customers fast access to online spending without waiting for physical cards.

A Visa Virtual Card API is flexible. It fits many use cases because it supports automation, reduces cost, and offers a simple experience for users in different regions.

Why Virtual Card APIs Are Growing So Fast Today

The modern world is fully digital. People want quick solutions, safe payments, and simple ways to manage money online. Companies also want to avoid complex paperwork, expensive card production, and slow delivery. A virtual card solves all of this.

The growth of global remote work, online subscriptions, and digital services has created a need for fast payment tools. A Mastercard or Visa Virtual Card API meets this demand by giving platforms an easy way to issue cards without depending on banks or physical systems.

The rise in online fraud also plays a part. Since virtual cards protect the main card information, they are becoming a preferred option for secure spending. Users feel more comfortable, and businesses gain more trust.

All of these reasons together explain why more companies are turning to virtual card technology.

CardUpNow Virtual Card API Service

CardUpNow also offers its own virtual card API service for businesses that want fast and flexible card issuing and want to resell or use these cards for their own. The API allows platforms to create virtual cards inside their own system without handling any manual work. With this service, a business can issue cards instantly, set spending limits, control usage rules, and monitor every transaction in real time. It helps companies give their users secure online payments with very little setup.

The API is designed to support different use cases such as team spending, digital purchases, subscription payments, remote work operations, and marketplace payouts. Every card issued through the CardUpNow API follows the same simple flow that the platform is known for. Businesses get automation, control, and global payment support, all through a clean and lightweight integration process. This makes the CardUpNow API a practical choice for startups, digital platforms, and growing companies that want to offer virtual card services without building their own system.

FAQ for Visa Virtual Card API

What is a virtual card API and how does it work?

A virtual card API is a software system that allows businesses to create and manage digital cards instantly. It works by connecting the company’s platform to the API, which generates cards, sets spending limits, tracks transactions, and controls card usage automatically.

Who can use a virtual card API?

Businesses of all sizes can use a virtual card API. Common users include fintech apps, subscription platforms, marketplaces, digital banks, and companies managing employee or vendor payments. It helps them automate payments and provide secure digital cards to users.

What are the benefits of using a virtual card API?

A virtual card API provides instant card creation, spending control, transaction tracking, and better security. It reduces manual work, protects main financial accounts, and allows businesses to issue cards globally for online payments, subscriptions, or team use.

Can I issue virtual cards for my customers using CardUpNow API?

Yes. The CardUpNow virtual card API allows platforms to issue Visa or MasterCard based virtual cards directly to customers or team members. The API supports spending limits, merchant control, and real-time tracking, making it easy to manage digital payments efficiently.

How quickly can I integrate a virtual card API like CardUpNow’s?

Integration is designed to be fast and simple. With the CardUpNow API, businesses can start issuing virtual cards within minutes of setup. The API is lightweight, fully documented, and supports smooth automation for digital payments and global transactions.