Online payments are now a normal part of daily life. People shop from international stores, pay for subscriptions, book services and run online businesses. Many want a simple and safe way to make these payments without depending on a traditional bank card. This is where the virtual prepaid Mastercard becomes useful. It gives people a digital card that works for most online payments and is easy to use from almost any country.

What Is a Virtual Prepaid Mastercard

A virtual prepaid Mastercard is a digital version of a prepaid card. It has the same card number, expiry date and security code that a normal Mastercard has, but you receive it online instead of getting a plastic card. You add money to it first, and you can only spend the amount you loaded.

Many people call it a Mastercard prepaid card online because you can get it instantly through a website instead of visiting a bank. It is also called a virtual prepaid Mastercard because it only exists in digital form and is ready to use on the internet.

A prepaid card is different from a credit card because it does not give you borrowed money. You spend your own money that you added earlier. It is also different from a debit card because it is not linked to a bank account. This makes it simple and safe for people who want more control over their spending or want to separate online payments from their main financial accounts.

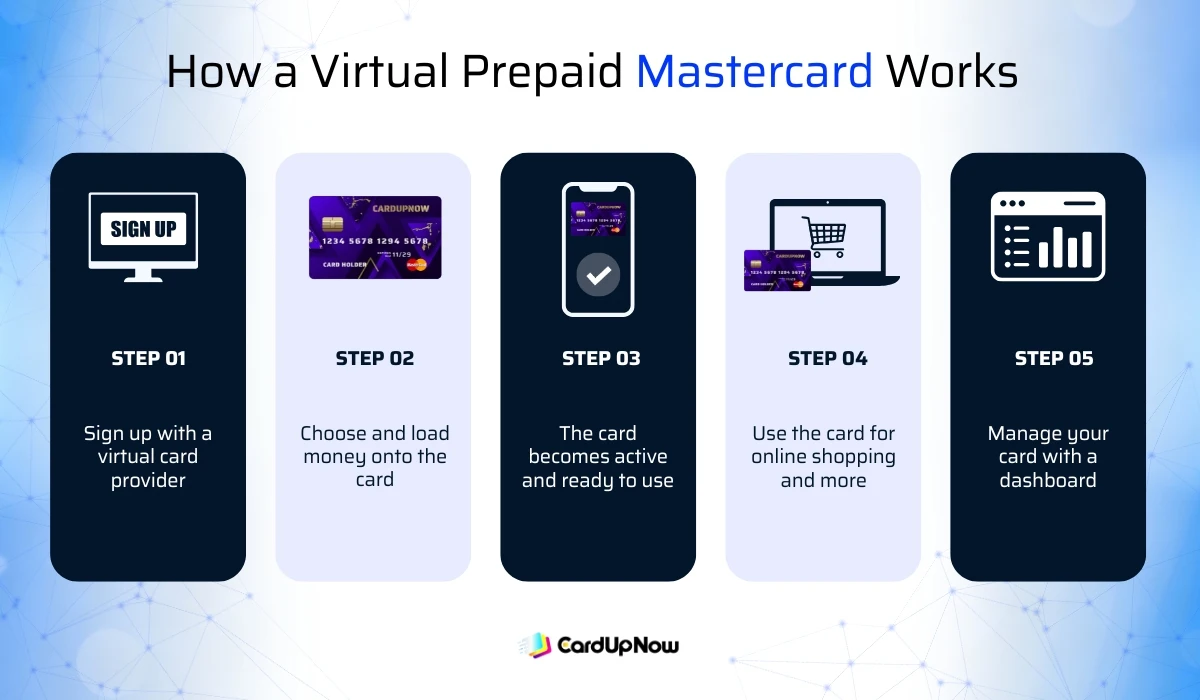

How a Virtual Prepaid Mastercard Works

A virtual prepaid Mastercard works in a very simple way. You sign up with a virtual card provider like CardUpNow and create an account. After signing up you can choose the type of card you want. Many platforms offer a reloadable Mastercard virtual card that you can use again and again by adding more funds.

Once you choose your card, you load money onto it. Some providers allow top ups through bank transfers, local wallets or crypto. After the money is added your card becomes active. The card details appear on your screen so you can copy them or save them securely.

You can now use the card for online shopping, subscription payments, digital ads, travel bookings and many other services. The merchant sees the card as a normal Mastercard even though it is virtual. The payment works the same way it would with a physical prepaid card.

Well established platforms also give a dashboard where you can see your balance, check your spending, freeze the card or delete the card if you no longer need it. Some platforms also let you create several cards to manage different types of payments. This is very helpful for people who want to keep their expenses organised.

Who Can Use a Virtual Prepaid Mastercard

A virtual prepaid Mastercard can help many types of users. The needs are different for each group, so the best way to understand the value is to look at their real use cases. Below are the most common groups who benefit from this card.

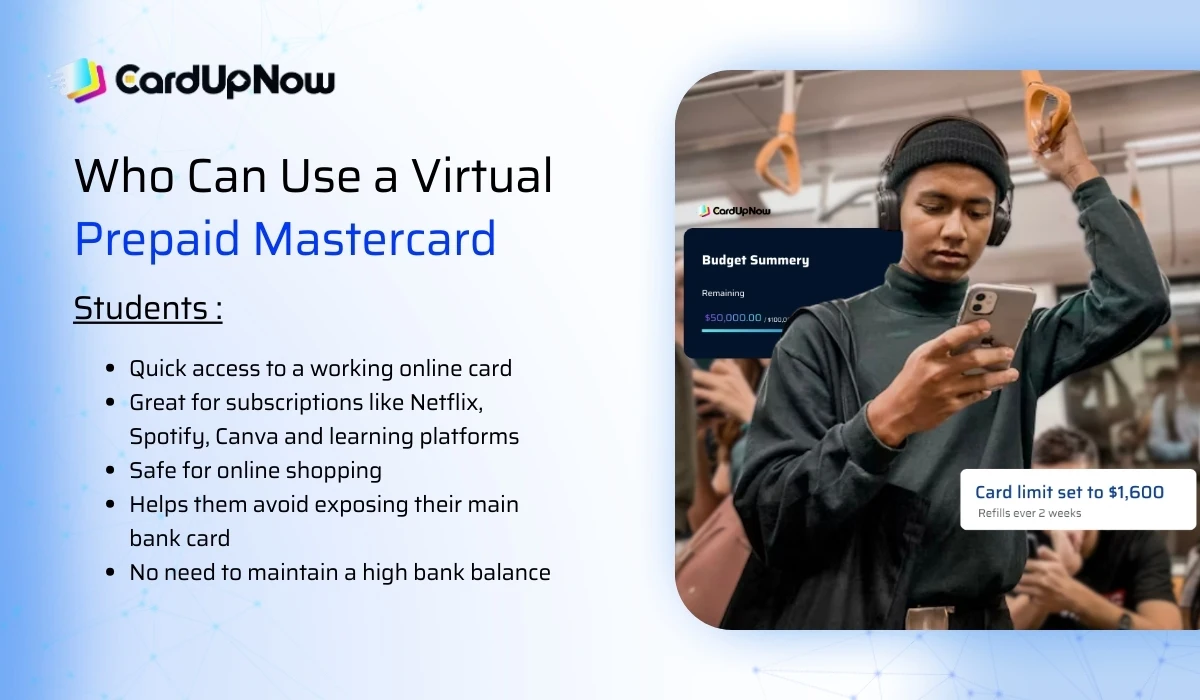

Students Who Need Easy Online Payments

Students often pay for simple online services like music, movies, courses and apps. Many do not have access to a full bank account or an international credit card. A virtual prepaid Mastercard solves this by giving them a quick way to make global payments.

Why it helps students:

- Quick access to a working online card

- Great for subscriptions like Netflix, Spotify, Canva and learning platforms

- Safe for online shopping

- Helps them avoid exposing their main bank card

- No need to maintain a high bank balance

Students enjoy the freedom to pay for global services without complicated steps or visits to a bank.

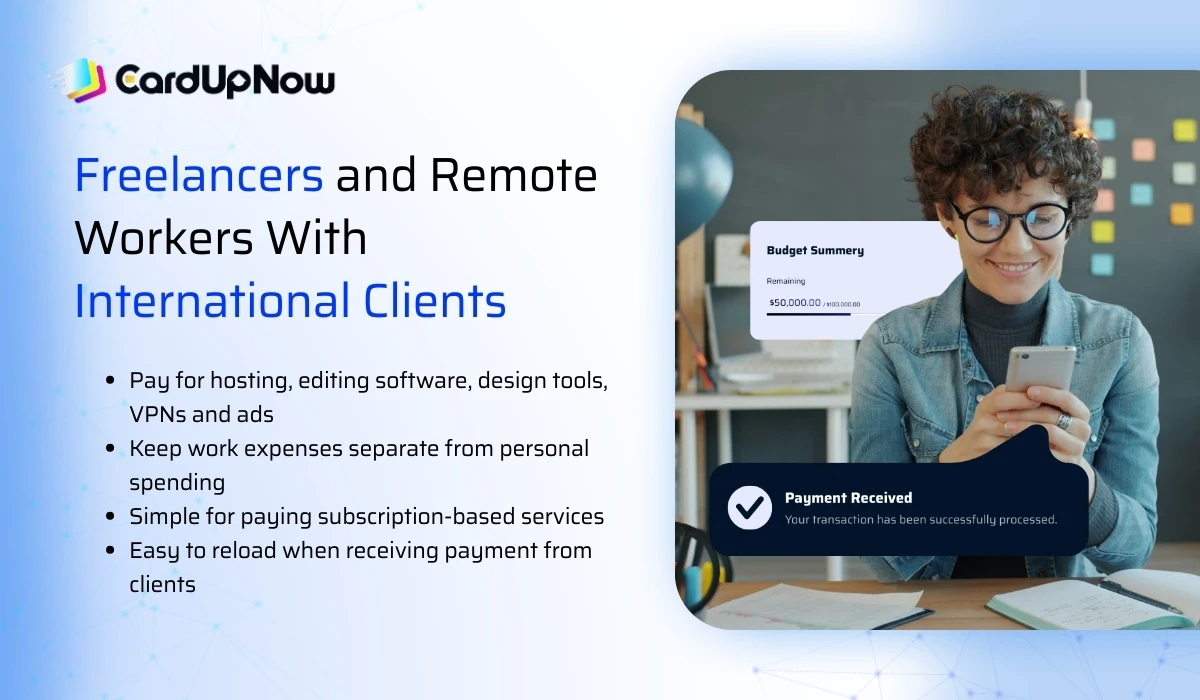

Freelancers and Remote Workers With International Clients

Freelancers and remote workers often need tools, software and online services to deliver their work. Many of these tools accept Mastercard but some countries do not issue international cards easily. A virtual prepaid Mastercard makes their work smoother.

Why it helps freelancers:

- Pay for hosting, editing software, design tools, VPNs and ads

- Keep work expenses separate from personal spending

- Simple for paying subscription-based services

- Easy to reload when receiving payment from clients

Since freelancers rely heavily on the internet, a prepaid virtual card gives them control and flexibility.

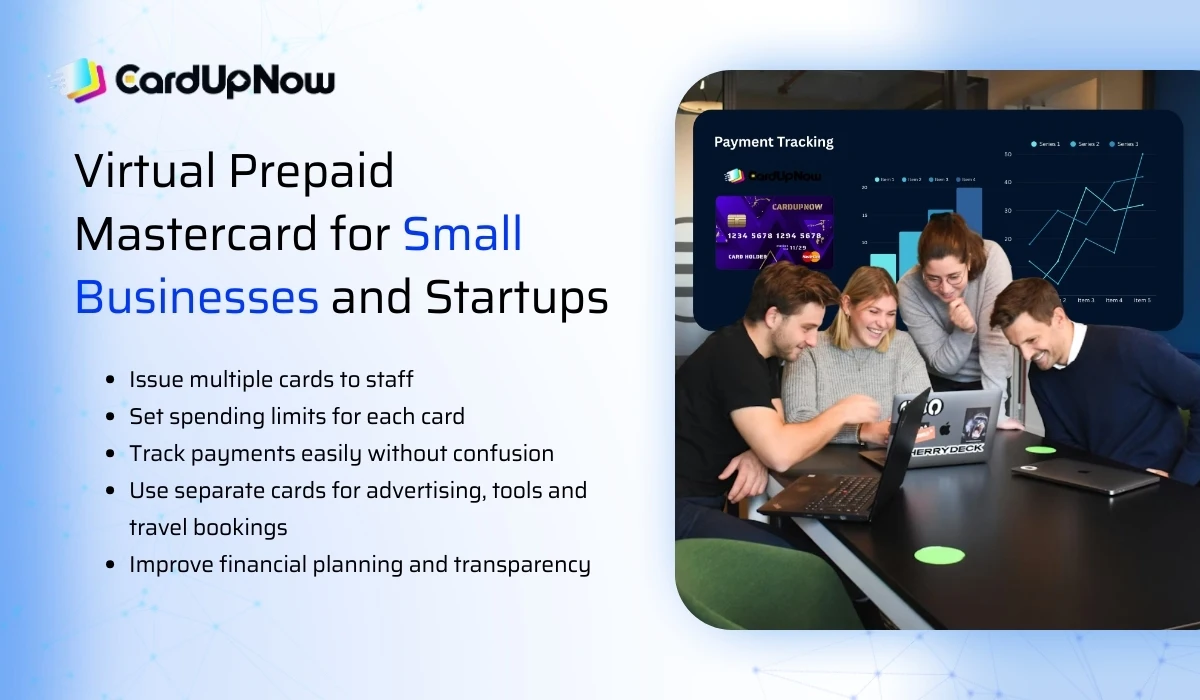

Small Businesses and Startups

Small companies need a clear way to manage expenses. A virtual prepaid Mastercard helps them stay organised by creating separate cards for different team members or departments.

Why it helps businesses:

- Issue multiple cards to staff

- Set spending limits for each card

- Track payments easily without confusion

- Use separate cards for advertising, tools and travel bookings

- Improve financial planning and transparency

Startups can control budgets more effectively and avoid overspending.

Online Shoppers Who Want Extra Safety

Many people shop online but worry about exposing their main bank cards. A virtual prepaid card gives them peace of mind.

Why it helps online shoppers:

- Keeps personal bank details safe

- Works on most global websites

- Users can create disposable cards for one-time purchases

- Reduces risk of fraud

- Helps avoid unexpected charges

This is very important for people who buy from international marketplaces.

Users in Countries With Limited Banking Access

Some regions have strict rules on international cards or foreign currency payments. People who live in these countries cannot easily get an international credit card. A Mastercard prepaid card online becomes a simple solution for them.

Why it helps these users:

- Offers a way to pay international merchants

- Useful for subscriptions not supported by local banks

- Helps bypass restrictions that stop global transactions

- Does not require a traditional bank account

This gives more financial freedom to users in places where payment options are limited.

People Who Buy Digital Products and Tools

Many users buy digital items such as ebooks, software licenses, games or cloud storage services. These platforms accept Mastercard, so the card works smoothly for them.

Why it helps digital buyers:

- Instant payments

- Great for one-time or recurring purchases

- Works globally for digital services

- Safe and easy to manage

People who are active online find this very convenient.

Key Benefits of a Virtual Prepaid Mastercard

A virtual prepaid Mastercard gives fast access to online payments because you receive the card within minutes. It is accepted by most websites around the world, which makes it useful for shopping, subscriptions and digital tools.

You stay in control of your spending because you can only use the money you add. This helps you avoid overspending and keep your budget organised. It also adds safety, since you can use disposable cards for risky sites or one time payments.

A reloadable card offers even more flexibility. You can top it up anytime and even use digital currency deposits if your provider supports them. Businesses can also benefit by giving staff separate cards and setting clear spending limits.

Limitations and Risks You Should Know

A virtual prepaid Mastercard is a very helpful tool but it still has some limitations. Some websites do not accept virtual cards for certain types of payments. These restrictions depend on the merchant’s rules, not the card provider. This can be frustrating for beginners who expect every site to accept virtual cards.

Another point to remember is that you cannot withdraw cash from a virtual prepaid card. It is made for online use only. You also need to check fees and currency conversion rates before making international transactions. These costs vary from one provider to another.

In some countries there are rules about who can use prepaid cards or how much money can be added to them. This is important for users in regions with strict financial laws. Some providers also have limits on maximum balance or number of transactions.

Customer support quality can also affect your experience. If your provider does not offer clear help or a simple dashboard you may face issues with refunds or merchant disputes

These risks do not make virtual prepaid cards unsafe. They only remind you to choose a reliable provider and understand how the card works before you start using it.

How to Choose the Right Virtual Prepaid Mastercard Provider

Choosing a good provider is important because it affects how smooth, safe and convenient your payments will be. Keep these points in mind before you decide:

- Look for instant card activation so you can start using it quickly.

- Choose a provider that offers both reloadable and disposable card options.

- Check the available top up methods and pick one that is easy to use in your region.

- Make sure the platform has strong security features like card freeze and spending alerts.

- Review the fees and limits to avoid unexpected costs.

- Businesses should look for tools like multiple cards and team controls.

- Pick a provider with helpful and responsive customer support.

Virtual Prepaid Mastercard Compared to Other Card Types

This table helps you see how a virtual prepaid Mastercard is different from other common card types. It shows how each card works and which one may fit your needs best.

| Card Type | How It Works | Main Advantages | Main Limitations |

| Virtual Prepaid Mastercard | You add money before using it. The card exists online with no physical version. | Easy to get, not linked to a bank account, safer for online payments, always available on your phone. | Only works for online payments, needs regular top ups. |

| Virtual Credit Card | Uses borrowed money from a bank. Needs approval and checks. | Good for large purchases, offers credit benefits. | Harder to get, risk of interest and overspending. |

| Physical Debit Card | Connected directly to your bank account. Money is taken instantly. | Simple and widely accepted for online and offline use. | If compromised, your whole bank balance is at risk. |

| Physical Prepaid Card | Works with money you load onto it, similar to the virtual prepaid card but in physical form. | Good for travel and offline purchases. | Takes time to arrive, can be lost or stolen, less convenient than a virtual card. |

Final Thoughts

A virtual prepaid Mastercard is a simple and powerful payment tool for anyone who wants safe and flexible online transactions. It helps stuÇdents, freelancers, shoppers and business owners manage their payments with comfort and confidence. It gives instant access, strong spending control and better privacy while still being accepted by most online merchants around the world.

If you want a fast and reliable way to get your own virtual prepaid Mastercard, you can explore CardUpNow and start using a secure digital card within minutes.