A virtual prepaid Mastercard is a simple and flexible way to make online payments. You receive the card details digitally, load money onto it and then use it just like a regular Mastercard for online transactions. Many people prefer virtual prepaid cards because they offer more control, better privacy and easy access for global payments. This guide explains exactly where you can use virtual prepaid Mastercard and how to get the most out of it.

What a Virtual Prepaid Mastercard Is

A virtual prepaid Mastercard is a digital card that works online. It has a card number, expiry date and security code just like a normal card. Since it is prepaid, you load money before using it. It is not connected to a bank account and this makes it safer and simpler for online payments. People use it for shopping, subscriptions, business tools and many other services.

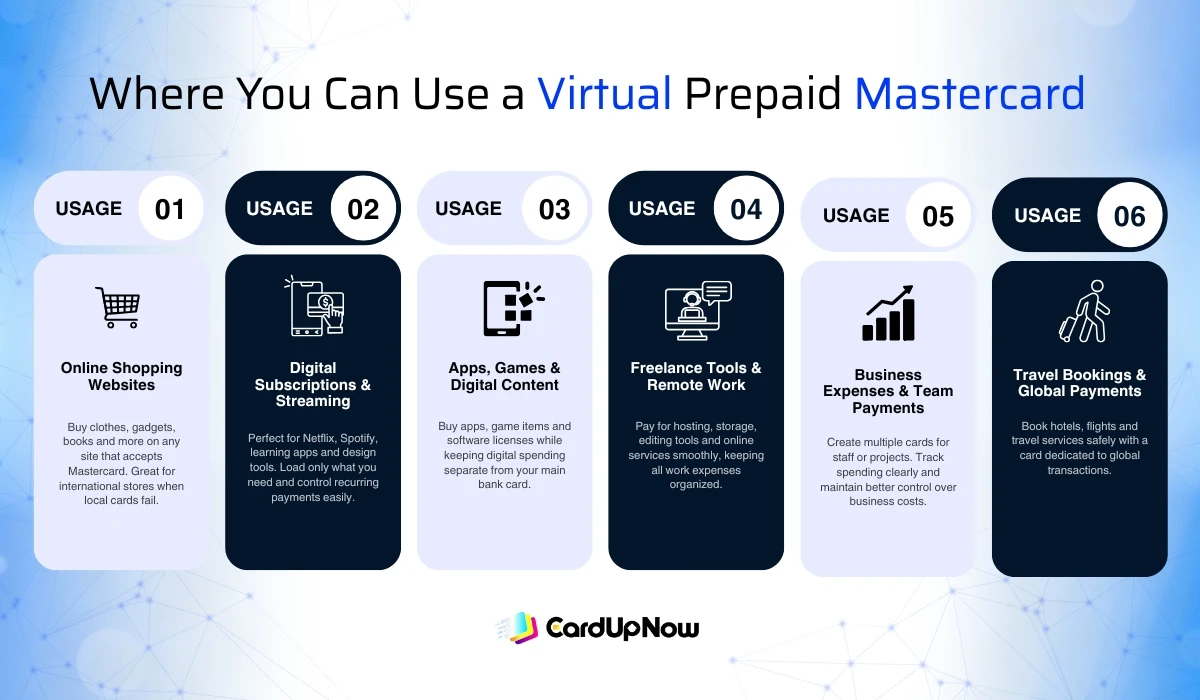

Where You Can Use Virtual Prepaid Mastercard

You can use virtual prepaid Mastercard in many places. Below are the main categories where it works well.

Online Shopping Websites

You can use your card to buy clothes, gadgets, books, beauty items and almost anything sold online. If the site accepts Mastercard, your virtual prepaid card usually works. Many people use it for international stores when their local cards do not work.

Digital Subscriptions and Streaming Services

A virtual prepaid Mastercard is great for monthly or yearly subscriptions. It works with platforms for movies, music, online learning, design tools, web hosting and more. This also helps you keep track of recurring payments because you can load only the amount you want to spend.

Apps, Games and Digital Content

If you buy apps, in game items, software licenses or digital content, a virtual prepaid card makes it easy. Many users enjoy this because it helps them keep their digital spending separate from their main bank card.

Freelance Tools and Remote Work Services

Freelancers and remote workers often need tools like editing platforms, online storage, marketing tools or domain hosting services. A virtual prepaid Mastercard helps pay for all these services without any difficulty. It also helps keep business spending organised.

Business Expenses and Team Payments

Small businesses and startups often use virtual prepaid cards to manage team expenses. They can create separate cards for different employees or projects. This gives them better control and a clear view of how money is being used.

Travel Bookings and Global Payments

You can also use virtual prepaid Mastercard to book hotels, flights or online travel services. It is useful for people who prefer to keep their main card safe or want a dedicated card for travel related spending.

When a Virtual Prepaid Mastercard May Not Work

A virtual prepaid Mastercard is designed mainly for online use. It usually cannot be used in stores that require a physical card. ATM withdrawals also do not work because the card is digital. Some merchants who need a physical card on file may not accept it. This depends on the merchant’s rules, so always check the payment page before completing your order.

How to Use Virtual Prepaid Mastercard

Here is a short and simple virtual Mastercard usage guide:

- Sign up with a provider and get your virtual card.

- Load money onto the card using any supported method.

- Keep your card details stored safely.

- Choose Mastercard at checkout and enter your card number, expiry date and CVV.

- Complete your payment once the balance is enough.

- Track your spending through your provider’s dashboard.

This process makes online payments easy, organised and secure.

Why People Prefer Virtual Prepaid Mastercards

People choose virtual prepaid Mastercards for many reasons. They like the privacy because the card is not linked to a main bank account. They enjoy the control since they can load the exact amount they want to spend. It also feels safer to use a virtual card for new websites or risky purchases.

Many users in different countries also pick these cards when their local bank cards do not work for international payments. Businesses use them to manage expenses with more clarity. Students use them for subscriptions. Freelancers use them to pay for tools without facing card restrictions.

Wrapping Up

A virtual prepaid Mastercard is a practical tool for online payments. You can use it for shopping, subscriptions, digital services, business tools, games and travel bookings. It offers safety, flexibility and better control over how you spend your money. For most online activities, the card works just like a regular Mastercard but with fewer complications and more freedom.

If you are looking for a simple and secure way to pay online, a virtual prepaid Mastercard can make your experience smoother and more comfortable.

FAQ

Can I use virtual prepaid Mastercard on Amazon?

Yes, you can use virtual prepaid Mastercard on Amazon as long as your card has enough balance and Amazon accepts prepaid cards in your region. Just enter the card details at checkout the same way you would use a normal Mastercard.

Can I use virtual prepaid Mastercard at an ATM?

No, a virtual prepaid Mastercard does not work at ATMs because it is a digital card. It is made for online payments and cannot be inserted into physical machines.

Can prepaid Mastercards be used anywhere?

A prepaid Mastercard can be used on most online platforms that accept Mastercard. Some services may not support prepaid cards, but for general online shopping, subscriptions, digital tools and many global websites, it works well.

How does a prepaid virtual Mastercard work?

A prepaid virtual Mastercard works by loading money onto it before making a payment. After you add funds, you receive the card details on your device and then use those details to pay online. It works just like a regular Mastercard for digital transactions.

Where can I use virtual prepaid Mastercard for everyday payments?

You can use virtual prepaid Mastercard for online stores, apps, games, subscriptions, freelance tools, travel bookings and most websites that accept Mastercard. It is one of the simplest ways to pay online without sharing your main bank card.