Virtual Visa cards have become one of the easiest ways to make payments online, manage subscriptions, and avoid card declines. But most people still wonder how they actually work behind the scenes. The idea sounds technical, yet the process is surprisingly simple once you understand the basics.

How Does a Virtual Visa Card Work? The idea sounds technical, yet the process is surprisingly simple once you understand the basics.A virtual Visa card is just like a normal Visa card, except you don’t receive any physical plastic card . Instead, you get the card number, expiry date, and CVV instantly on your screen. You can then use it on any website or service that accepts Visa. It works the same way your regular card works in a faster, safer, and much more flexible way.

A Visa Card Without the Plastic

When you create a virtual Visa card, you receive a unique set of card details generated by the virtual card issuer. These details are securely linked to your digital balance. Every time you make a purchase, Visa processes the payment just like it does with physical cards. The difference is that everything happens online, no card swiping, no chip, and no tap required.

This digital format gives you instant access and full control. If you want to pause the card, freeze it. If you want a new one, create it. If a website looks suspicious, use a separate virtual card instead of risking your main bank card.

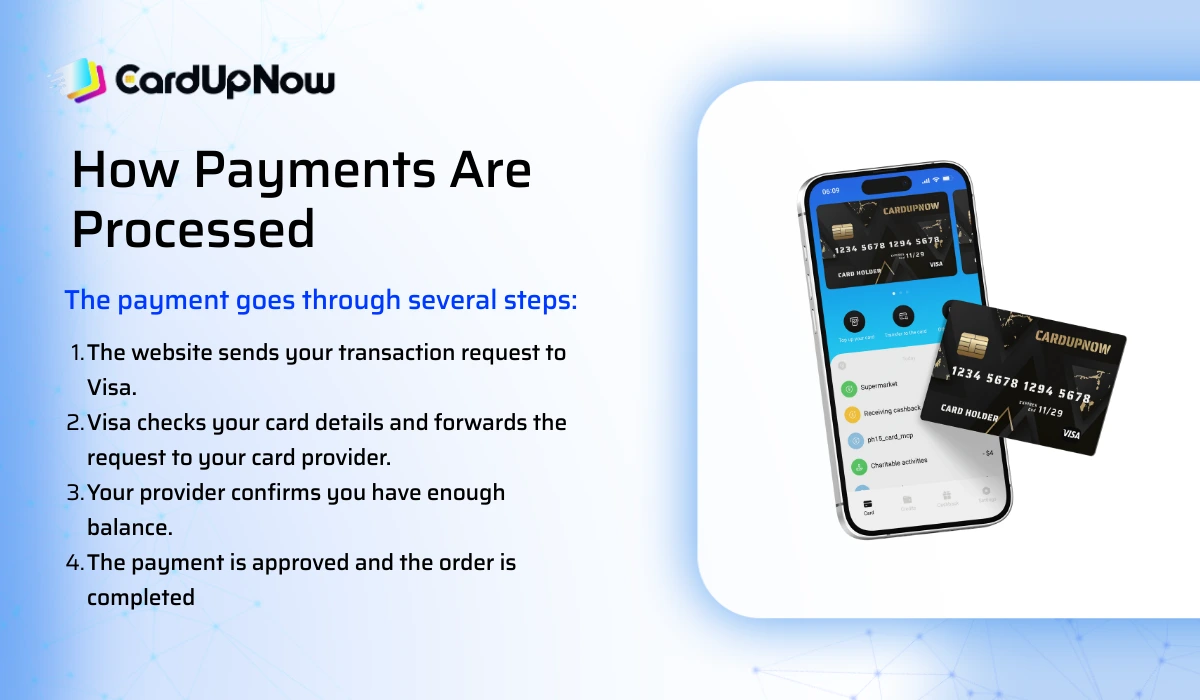

How Payments Are Processed

When you enter your virtual card details on a website, the payment goes through several steps:

- The website sends your transaction request to Visa.

- Visa checks your card details and forwards the request to your card provider.

- Your provider confirms you have enough balance.

- The payment is approved and the order is completed.

This entire process takes only a few seconds. The speed and accuracy are the same as any physical Visa card. The only difference is that you’re using a digital card number instead of a plastic card.

Funding Your Virtual Visa Card

A virtual Visa card needs a balance to work, and that’s where the flexibility begins. On CardUpNow, you can add funds instantly, and you’re not limited to traditional banking methods. Many users prefer crypto top-ups because they are fast, convenient, and avoid the international payment issues common with certain banks.

Once the card is funded, you can spend anywhere online that accepts Visa prepaid cards for shopping, subscriptions, travel bookings, ads, software tools, and more.

Security Behind the Virtual Card

One of the biggest reasons people switch to virtual Visa cards is safety. Since the card details can be replaced anytime, you’re never exposing your main bank account. If a website seems risky or if you’re signing up for a free trial that might auto-renew later, using a virtual card protects you from unexpected charges.

You can freeze the card instantly, delete it, or limit how much it can spend. This level of control is something traditional cards simply can’t match.

Managing Multiple Cards With Ease

This is where platforms like CardUpNow stand out. You can create different virtual Visa cards for different needs: one for subscriptions, one for online shopping, one for ads, one for travel, and even one for client-related payments if you run a business.

Each card has its own settings and spending history, so managing your budget becomes much easier. Instead of everything blending into one card statement, each card tells its own story.

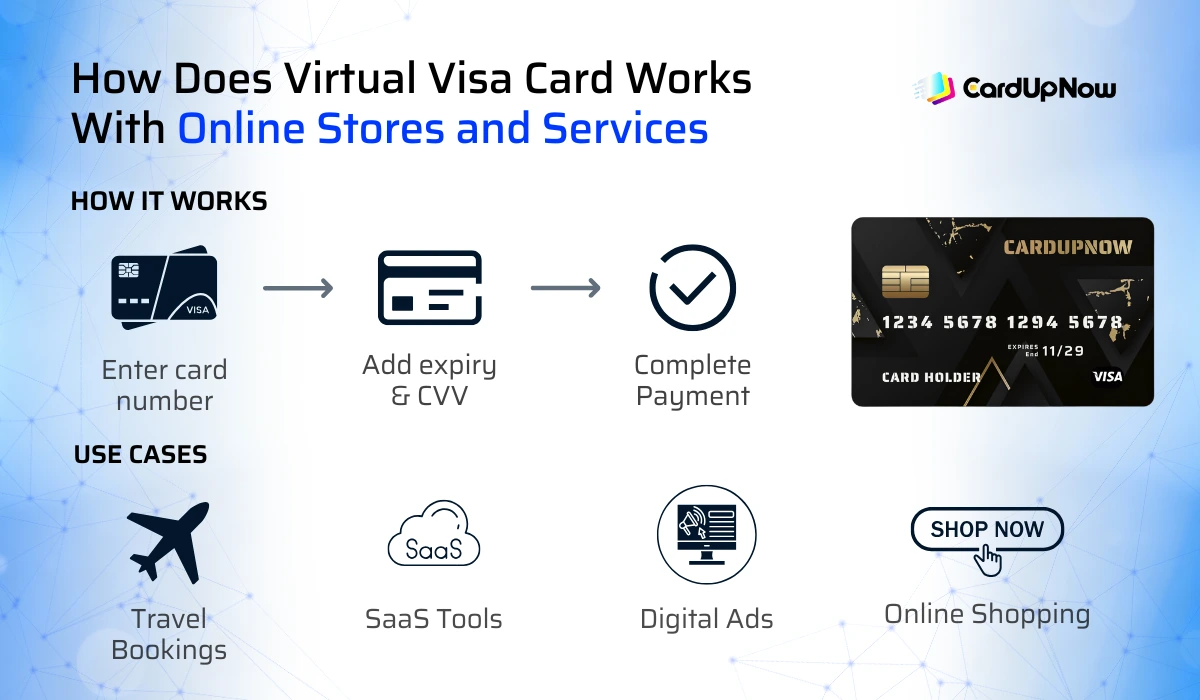

How Does Virtual Visa Card Works With Online Stores and Services

Most online platforms accept virtual Visa cards the same way they accept any other Visa card. You simply enter the details and complete your payment. There’s no special process or extra steps. For prepaid travel bookings, SaaS tools, digital ads, and online shopping, virtual cards work flawlessly.

Why Users Prefer Virtual Cards Today

People choose virtual Visa cards for different reasons: some want privacy, some want better control, some are tired of card declines, and others love the speed. But no matter why you start using one, the daily convenience quickly becomes clear.

- You don’t wait for the card to arrive.

- You don’t worry about losing it.

- And you don’t expose your main bank card to every website you visit.

Final Thoughts

A virtual Visa card works just like your normal Visa card but gives you more flexibility, more protection, and more control over your digital spending. From instant payments to safe online shopping, it fits perfectly into how we use the internet today.

With CardUpNow, the experience becomes even smoother. You create cards in seconds, fund them easily, and manage multiple cards without any stress. Once you start using a virtual card for your payments, it becomes one of the smartest tools in your digital wallet.

FAQ about how does a virtual visa card work

How does a virtual Visa card actually work?

A virtual Visa card works just like a normal Visa card, except it exists only in digital form. You receive a card number, expiry date, and CVV instantly, and these details can be used to make online payments anywhere Visa is accepted. When you complete a purchase, the website sends your transaction to Visa, your balance is checked, and the payment is approved. This entire process happens in seconds. It’s fast, secure, and gives you more control over your online spending.

Where can I use a virtual Visa card?

You can use a virtual Visa card on almost any online platform that accepts Visa. This includes e-commerce stores, digital subscriptions, online travel websites, SaaS tools, and ad platforms. Many users prefer virtual cards for global payments because they reduce declines and offer extra security. For anyone searching “where to use virtual Visa card,” the simple answer is: nearly all online merchants support virtual card acceptance without any special steps.

Can you use a virtual Visa card in store?

You can use a virtual Visa card in physical stores if the store supports Apple Pay or Google Pay. Once you add your virtual card to your mobile wallet, you can tap to pay just like you would with a physical card. If the store only accepts chip, swipe, or PIN without contactless options, then the virtual card will not work. In-store use depends entirely on the merchant’s payment terminals, not the card itself.

Is a virtual Visa card safe for online payments?

Yes. Virtual Visa cards are considered safer than physical cards because your real bank card details are never exposed online. You can freeze, replace, or delete a virtual card at any time, which protects you from fraud, unwanted charges, or risky websites. This level of control makes virtual cards ideal for subscriptions, first-time purchases, and international payments. For anyone concerned about virtual card acceptance, security is one of the biggest advantages.

How do I add money to a virtual Visa card and start using it?

Most virtual Visa cards are funded digitally. On CardUpNow, you can load your card instantly using various payment options, including crypto top-ups for fast global access. Once your balance appears, you can use the card immediately on any website that accepts Visa. Because the card is activated instantly, there’s no waiting for physical delivery — which is one of the reasons users prefer virtual cards for urgent payments and international transactions.