Online payments are changing fast. People now want speed, safety, and full control. They want a card that works instantly, protects their money, and never puts them at risk. They want freedom from declined payments, blocked banks, and long verification steps.

That is why the Mastercard virtual account is becoming a top choice for online buyers, freelancers, remote workers, global shoppers, and digital businesses. It gives you a ready-to-use card number within seconds. No waiting time. No paperwork. No physical card. Just smooth payments on almost every global platform.

If you buy online, pay for tools, or run a business that depends on digital spending, this is one of the simplest and safest payment methods you can use right now.

What Is a Mastercard Virtual Account?

A Mastercard virtual account is a digital version of a card. It has a card number, expiry date, and CVV, but you do not get any physical card. You use it for online payments just like a normal Mastercard.

The main idea is simple. You get a card number instantly inside a platform or app, and you can start paying online right away. This digital format gives more speed and more protection because your real information stays safe. Many banks, fintech apps, and digital card providers now offer virtual Mastercards for both personal and business use.

There are two main types:

- Personal virtual accounts for online shopping, subscriptions, gaming, tools, and digital services.

- Business virtual accounts for team spending, vendor payments, automated billing, and platform integrations.

Even prepaid or gift-based virtual Mastercards exist, but they have limitations.

How a Mastercard Virtual Account Works

Many Mastercard virtual account works just like a normal card, with one big difference: everything happens online. You receive a virtual card number inside an app or platform. That number acts as your payment method and works on almost all online stores that accept Mastercard.

Every virtual account includes:

- A 16-digit card number

- Expiry date

- CVV

- Balance or funding source

- Online payment capability

- Security controls inside the platform

When you make a payment, the system uses encryption and tokenization to protect your details. Your real card information stays hidden. Many providers allow you to freeze or delete the card anytime for extra safety. Some even offer single-use cards for unknown websites.

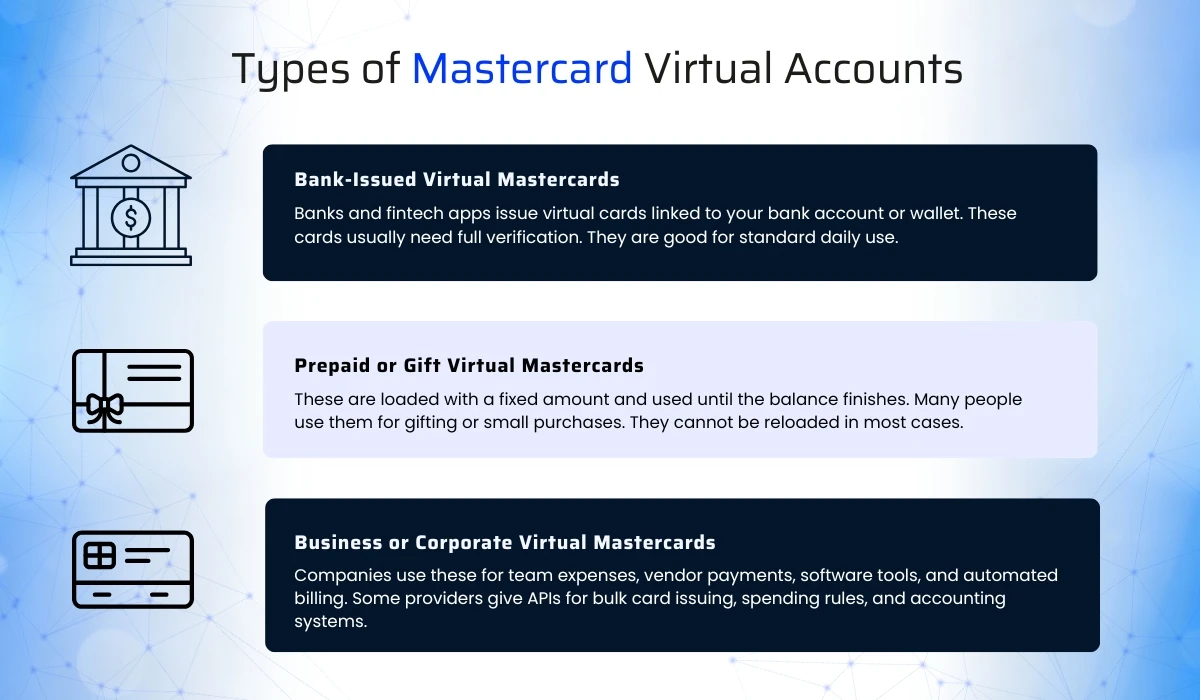

Types of Mastercard Virtual Accounts

Different providers offer different types based on your needs. Here are the common ones:

Bank-Issued Virtual Mastercards

Banks and fintech apps issue virtual cards linked to your bank account or wallet. These cards usually need full verification. They are good for standard daily use.

Prepaid or Gift Virtual Mastercards

These are loaded with a fixed amount and used until the balance finishes. Many people use them for gifting or small purchases. They cannot be reloaded in most cases.

Business or Corporate Virtual Mastercards

Companies use these for team expenses, vendor payments, software tools, and automated billing. Some providers give APIs for bulk card issuing, spending rules, and accounting systems.

Main Benefits of a Mastercard Virtual Account

A Mastercard virtual account brings many benefits that make online payments stronger and easier. The biggest benefit is protection. Your real card number is not exposed anywhere. If the virtual card gets leaked, you can freeze or replace it instantly without touching your main account.

Another advantage is speed. You do not wait for shipping. You do not fill long forms. You get a working payment method in seconds and use it instantly.

People also like the spending control. You can limit payments, stop subscriptions, and track transactions in real time. Many platforms allow multiple virtual cards under one profile, which helps organize expenses.

Businesses enjoy clean payment flows. They can generate individual cards for vendors, employees, or tools. It makes accounting simple and improves transparency.

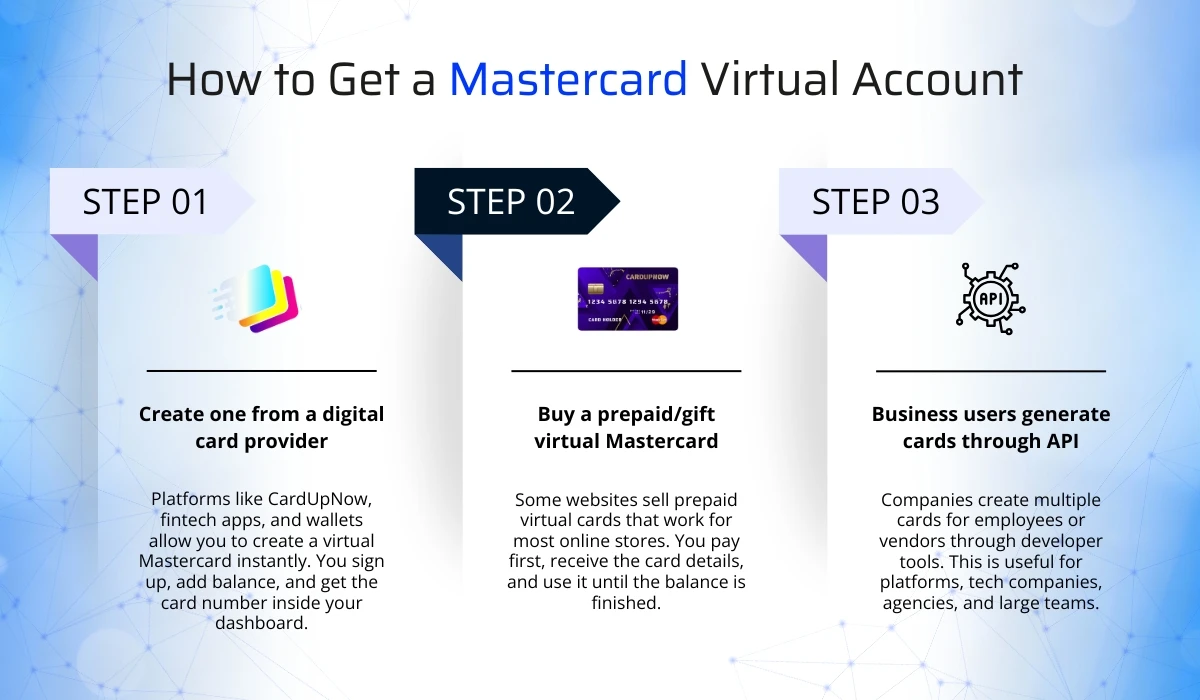

How to Get a Mastercard Virtual Account

Getting a Mastercard virtual account is simple. Online users use two main methods:

1. Create one from a digital card provider

Platforms like CardUpNow, fintech apps, and wallets allow you to create a virtual Mastercard instantly. You sign up, add balance, and get the card number inside your dashboard.

2. Buy a prepaid/gift virtual Mastercard

Some websites sell prepaid virtual cards that work for most online stores. You pay first, receive the card details, and use it until the balance is finished.

3. Business users generate cards through API

Companies create multiple cards for employees or vendors through developer tools. This is useful for platforms, tech companies, agencies, and large teams.

Mastercard Virtual Account Providers

Below is a simple comparison of popular providers. This helps you understand how CardUpNow stands out.

| Provider | Card Type | Instant Activation | KYC | Best For |

| CardUpNow | Virtual Prepaid Mastercard | Yes | No KYC | Fast payments, online tools, global shopping |

| Privacy.com | Virtual Mastercard-style cards | Yes | Required | Subscription protection & privacy |

| Revolut | Bank-linked virtual card | Yes | Full KYC | Global users & travel |

| Wise | Virtual debit card | Yes | Full KYC | International payments |

Why CardUpNow Is a Smart Choice for a Mastercard Virtual Account

CardUpNow gives simple, fast, and global virtual card access. You get your Mastercard virtual account instantly after sign-up. The process is smooth, and you can load balance through crypto. No paperwork. No waiting. No complex rules.

Our system supports global online payments with strong protection. Every card comes with real-time balance updates, controlled spending, and safe online use. Developers can also use the CardUpNow API to create cards in bulk or manage automated transactions.

If you want a virtual Mastercard without long forms or long delays, CardUpNow gives a clean and practical solution for both personal and business use.

FAQ

Is a Mastercard virtual account the same as a virtual card?

Yes, both terms mean the same thing. You get a digital card number for online payments without a physical card.

Can I use a Mastercard virtual account for subscriptions?

Yes, most streaming and online services accept virtual Mastercards for recurring payments.

Do I need KYC for a Mastercard virtual account?

Many providers require verification. CardUpNow gives you instant access without KYC.

Can I use a Mastercard virtual account for international websites?

Yes, Mastercard is widely accepted on global platforms, so you can use it almost anywhere online.

How long does a virtual Mastercard last?

It depends on the provider. Some cards last for a long time, and some prepaid cards expire sooner. You can always check the expiry inside the platform.

A Mastercard virtual account gives speed, control, and strong protection. It is one of the easiest ways to pay online without exposing sensitive details. If you want fast access and smooth global usage, CardUpNow helps you start in just a few seconds.