Mahadi had been working from his small home office for nearly a year. He often handled digital projects from clients around the world. One morning, after completing a big assignment, he received an email with a reward. Instead of a bank transfer, he found a link that said he had been given a visa incentive virtual card. He clicked on it, activated the balance, and within minutes, he was using it to pay for his monthly software, gaming credits, and a few things he wanted from an international store. No waiting, no extra steps, and no need to visit any physical place. It was simple, clear, and perfect for someone who handles everything online.

Stories like this are very common. People receive these cards as part of reward programs, loyalty bonuses, promotional gifts, and company incentives. The card arrives fast and works on many websites, which makes it a practical choice for almost any user. This blog explains everything you need to know in a friendly way so you understand how these cards work and how you can use them confidently.

What Is a Visa Incentive Virtual Card

A visa incentive virtual card is a digital prepaid Visa card. It is usually sent through email and works like a regular card for online payments. Companies use it as a reward because the delivery is instant, the activation is simple, and the user can spend the balance without dealing with any physical card.

This type of card comes with a fixed amount of money. You can use it on websites that accept Visa prepaid payments. Many programs issue these cards after completing surveys, joining reward campaigns, attending training programs, or winning promotional offers.

Since everything is digital, it is safe and convenient for modern users. Many people prefer receiving this card because it avoids bank transfer delays, international fees, and complicated paperwork. It brings comfort to people who shop online, subscribe to digital tools, or make global payments regularly.

How a Visa Incentive Virtual Card Works

When someone receives a visa incentive virtual card, they do not receive a physical item. Instead, they get an email with all the details needed for online payments. The information usually includes a card number, expiry date, and security code.

The process works like this:

- You open the email that contains the activation link.

- You activate the card on the provided website.

- The balance appears instantly.

- You use the card on websites that accept Visa prepaid cards.

- You shop or pay until the balance is fully used.

There are no shipping delays, no paperwork, and no long steps. This is why companies prefer issuing this digital reward. It reduces cost, avoids delivery issues, and creates a smooth experience for the user.

The digital nature of the card also offers safety. If you do not want to use your main card for small online purchases, this card can help protect your information. Many users feel more comfortable using a prepaid card for subscriptions, game top-ups, and digital purchases.

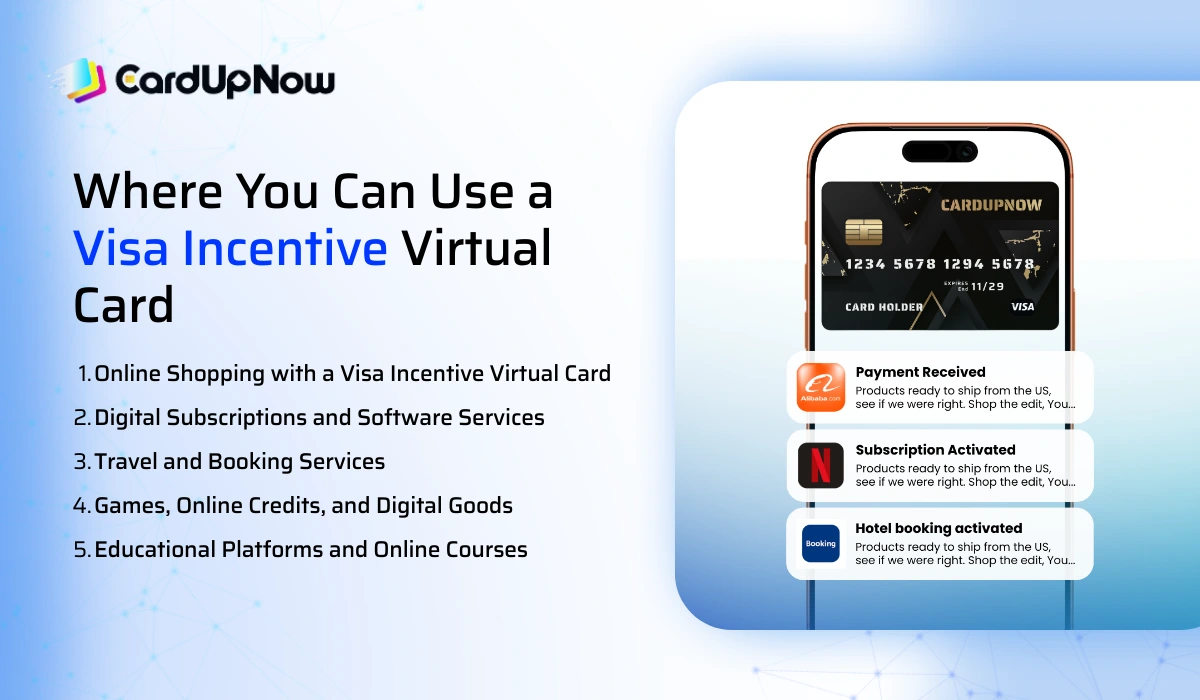

Where You Can Use a Visa Incentive Virtual Card

A visa incentive virtual card works on many online platforms around the world. People love it because it supports global payments without the need for a bank account or physical card.

Here are the most common places where the card can be used:

Online Shopping with a Visa Incentive Virtual Card

You can buy clothing, electronics, accessories, home essentials, beauty items, mobile gadgets, and more. Many international stores accept Visa prepaid cards, which helps users from any region shop easily.

Online shoppers use it for fashion stores, gadget websites, lifestyle shops, and platforms that sell imported products.

Digital Subscriptions and Software Services

This card works perfectly for subscriptions and digital tools. You can pay for streaming apps, domain services, hosting platforms, design tools, editing apps, and cloud services. Many users use this card for Netflix, design software, video tools, and app store expenses. It creates a secure payment environment and prevents your primary card information from being exposed.

Travel and Booking Services

You can book hotels, flights, car rentals, and travel packages if the platform accepts Visa prepaid cards. Many global travel websites support these payments, which helps users manage bookings without using their main bank card.

Games, Online Credits, and Digital Goods

Gamers often prefer prepaid cards for security and simple spending control. You can buy game credits, in-game items, gift codes, top-ups, and app store goods. Since the card comes with a fixed balance, it helps keep spending under control.

Educational Platforms and Online Courses

Many learning websites accept Visa for purchasing courses and digital lessons. Students and professionals find the card convenient because they can quickly use the balance for classes, certifications, and study tools.

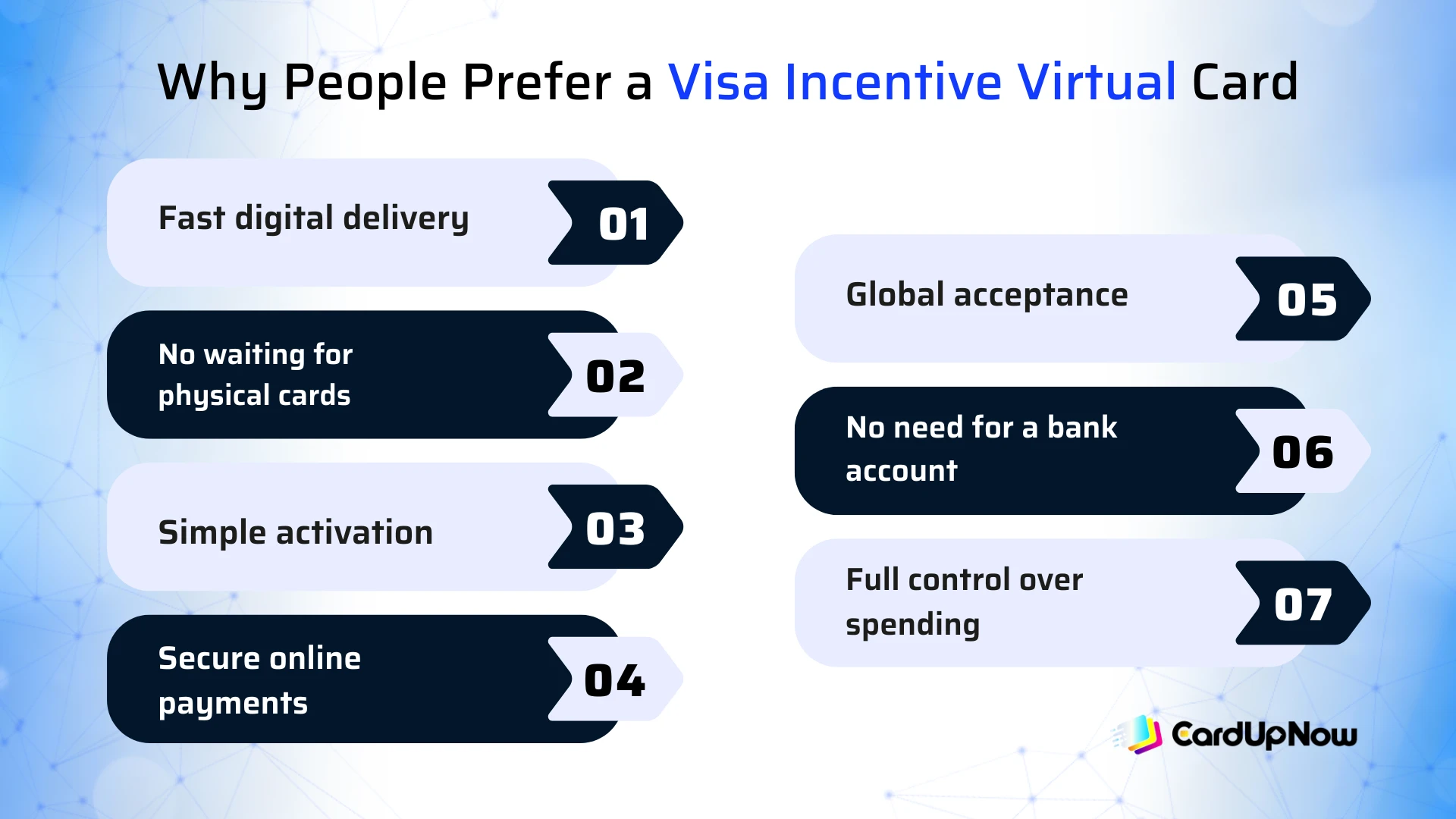

Why People Prefer a Visa Incentive Virtual Card

Users enjoy several benefits when they receive these cards. Here are the main reasons:

- Fast digital delivery

- No waiting for physical cards

- Simple activation

- Secure online payments

- Global acceptance

- No need for a bank account

- Full control over spending

The freedom to use the card instantly makes it very appealing. Many people use it regularly for online shopping, subscriptions, and digital services because it is quick and safe.

Companies prefer it as a reward option because it avoids shipping costs and gives users instant satisfaction. It also helps businesses reward people in different countries without dealing with complex financial systems.

Benefits of Using a Visa Incentive Virtual Card

A visa incentive virtual card offers comfort, speed, and security. It lets you access global services, pay for essential online tools, and complete transactions without exposing your main bank card information. It supports digital buyers, remote workers, students, and everyday online shoppers.

The card fits perfectly in a world where most payments happen online. You only need your phone or laptop to use it, which makes it ideal for people who prefer fast and simple payment methods.

Have a Look At CardUpNow

If you are looking for a dependable virtual card for daily online spending, CardUpNow makes everything simple. You can create a virtual card in minutes without paperwork. It supports global payments, online subscriptions, software tools, shopping platforms, and many digital services. CardUpNow is designed for people who want fast access to secure online payments without any complicated setup.

FAQ for Visa Incentive Virtual Card

How do I activate a visa incentive virtual card?

You activate it by opening the link sent to your email. The balance becomes ready to use once you complete the steps on the activation page.

Can I use a visa incentive virtual card for global online shopping?

Yes. Most international websites that accept Visa prepaid payments support this card. It works well for digital services, shopping platforms, and many online marketplaces.

Are there any fees on a visa incentive virtual card?

There are normally no monthly fees. Some issuers may charge a small inactivity fee if the card remains unused for a long period.

Can I add a visa incentive virtual card to Apple Wallet or Google Wallet?

Some cards support mobile wallets. It depends on the rules set by the reward provider.

What happens once the balance is fully used?

The card becomes inactive once the balance reaches zero. It is designed as a prepaid reward card and cannot be reloaded.