A virtual prepaid card is a digital card that you load with money and then use for online payments. It works like a regular Visa or Mastercard, but it exists only on your screen. You get the card number, expiry date, and CVV instantly, so you can start paying online without waiting for any plastic card.

Digital payments are now a big part of everyday life. People shop online, subscribe to global platforms, pay for tools, buy apps, and use services from different countries. A virtual prepaid card fits perfectly into this world because it gives you safety, privacy, and trouble-free payments without linking your main bank card everywhere.

If you want something fast and globally accepted, CardUpNow offers a smooth solution with its crypto-powered virtual prepaid card. But before choosing any provider, you should understand what is a virtual prepaid card, how they work, and where they work best.

How a Virtual Prepaid Card Works in the Real World

A virtual prepaid card follows a simple process. You open an account with a provider like CardUpNow, complete a short verification, load money into your digital wallet, and your card becomes active instantly. Since it is prepaid, you only spend the balance you add. This gives you strong control over your spending and protects your main bank account from exposure.

Once active, the card works for almost all online payments that support Visa or mastercard. You can use it for shopping, subscriptions, apps, entertainment services, digital platforms, and international websites where traditional cards sometimes fail. The best part is the flexibility. If you want to freeze the card, change spending limits, or add more balance, you can do everything from your device.

Virtual Prepaid Card vs Credit, Debit, and Other Virtual Cards

Most beginners get confused because there are many card types available online. A virtual prepaid card is different from a debit or credit card because it does not connect to your bank account or credit line. Whatever amount you add is all you can spend.

This makes it ideal for people who want extra safety or need a card that works independently from their main finances. It is also different from a virtual debit card because a virtual prepaid card is reloadable and not tied to any specific bank. And compared to promotional virtual cards, which brands sometimes offer as rewards, a real virtual prepaid card has long-term use, consistent acceptance, and full control.

CardUpNow offers a reloadable Visa prepaid virtual card that allows everyday usage, subscription payments, online shopping, and international digital transactions.

Why More People Prefer Virtual Prepaid Cards Today

The biggest reason people choose a virtual prepaid card is safety and privacy. When you pay online, there is always a risk of data leaks, hidden charges, or unreliable merchants. A prepaid card protects you by limiting the risk to the prepaid balance. Even if the card details ever get exposed, your main money stays safe.

People also enjoy the budget control. Since you load the balance yourself, you always know how much you are spending. Students, freelancers, digital buyers, and online shoppers use virtual prepaid cards to track their spending without surprises.

Another strong advantage is the global acceptance. A prepaid virtual card works across most international online platforms. Many users face issues where their local banks block transactions, especially on digital services. A reloadable Visa or Master card online solves this problem because it works independently and more reliably for digital purchases.

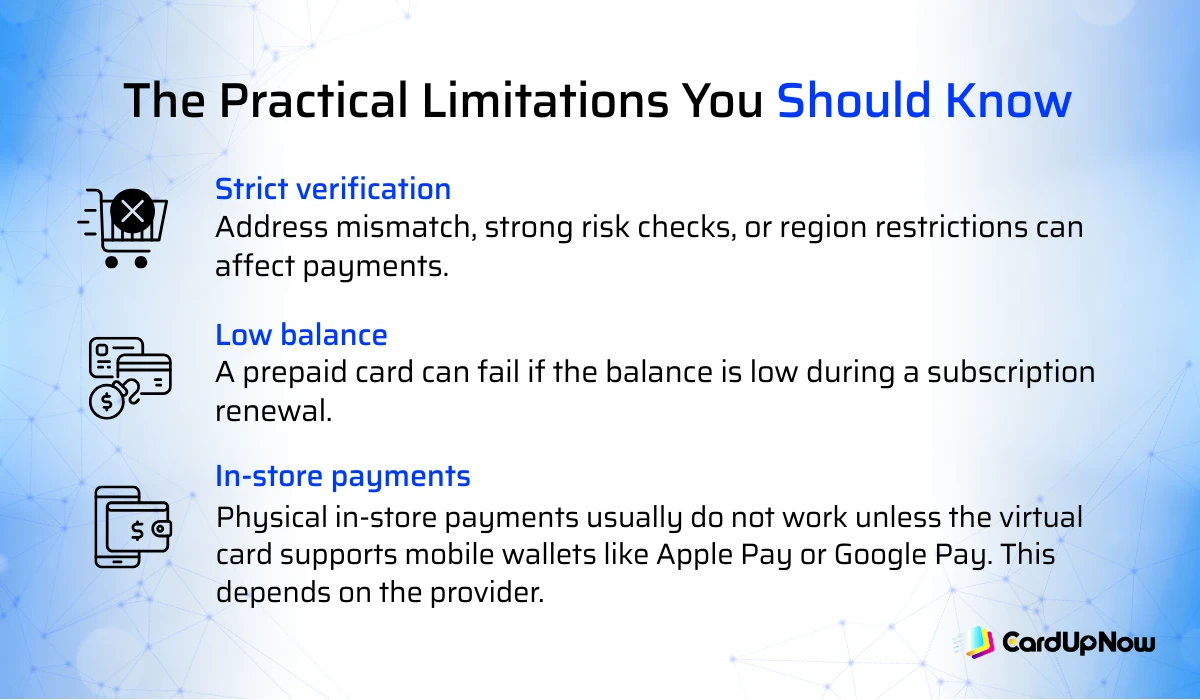

The Practical Limitations You Should Know

Most virtual card providers avoid discussing limitations, but a well-informed user should know these points:

- Some merchants use strict verification systems. Address mismatch, strong risk checks, or region restrictions can affect payments. Also, most virtual cards do not support large security holds used by hotels or airlines. They prefer cards with credit lines.

- A prepaid card can also fail if the balance is low during a subscription renewal. This is not a technical problem, just a simple balance issue. Keeping a small buffer solves it instantly.

- Physical in-store payments usually do not work unless the virtual card supports mobile wallets like Apple Pay or Google Pay. This depends on the provider.

CardUpNow provides clear balance updates and transaction notifications so users can avoid these common issues.

Fees You Should Understand Before Choosing Any Provider

Many users only discover hidden fees after using the card. Common fees include loading fees, international charges, currency conversion, and inactivity penalties. These vary widely from provider to provider.

CardUpNow keeps the model transparent. Users can check all fees in the dashboard before making any payment. You should always choose a provider that shows fees openly instead of hiding them deep inside terms and conditions.

Practical Use Cases for a Virtual Prepaid Card

A virtual prepaid card fits several types of online payments:

For online shopping, it protects your main card from unknown websites and international sellers. For subscriptions, it reduces the chance of random declines and keeps your billing separate. Freelancers and digital workers use these cards to pay for online tools, cloud platforms, ads, and software.

Students use virtual prepaid cards to control monthly spending, and many users prefer them for international payments because they work where local cards sometimes fail. The card also provides a clean spending record, which helps with budgeting and personal finance tracking.

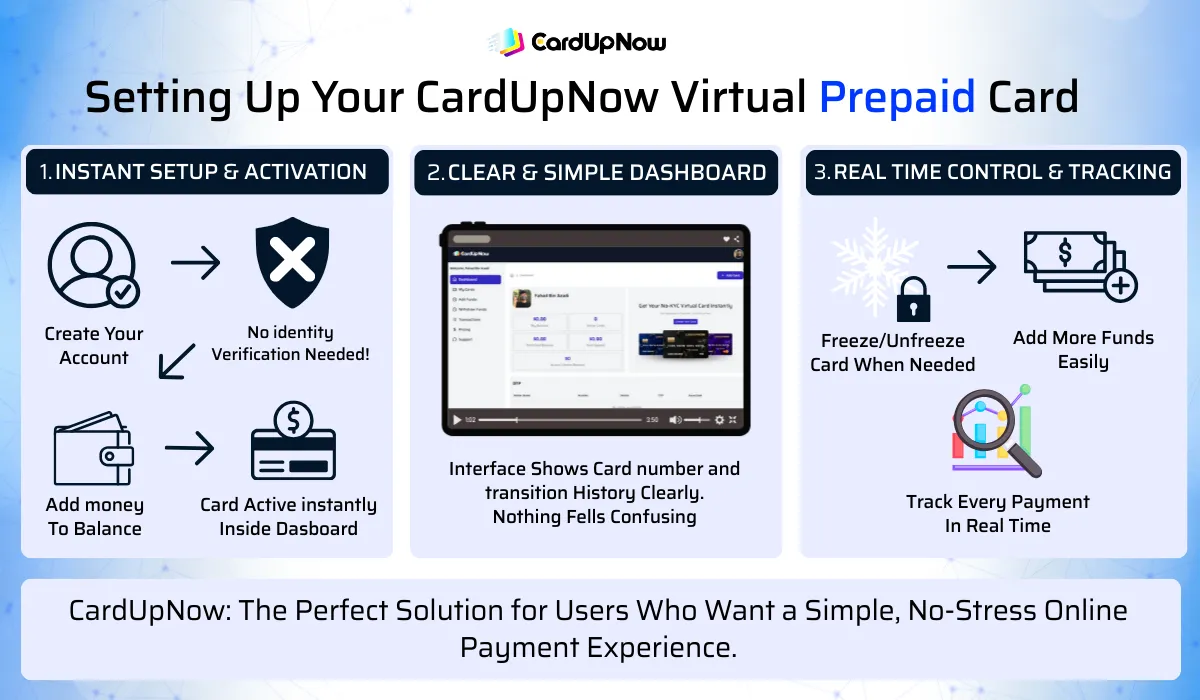

Setting Up Your CardUpNow Virtual Prepaid Card

The process is friendly for beginners. You create your account, no need to verify your identity, add money to your balance, and your card becomes active instantly inside the dashboard. The interface shows your card number and transaction history clearly, so nothing feels confusing. You can freeze or unfreeze your card when needed, add more funds, and track every payment in real time.

This makes CardUpNow suitable for users who want a simple, no-stress online payment solution.

Security Features That Protect Your Money

A good virtual prepaid card must offer more than convenience. It must protect your identity, payment details, and balance. CardUpNow uses encrypted data handling, secure card tokenization, and strong fraud monitoring to keep users safe. You can freeze the card instantly and track every action inside your account.

This level of control gives users confidence when paying online, especially on international websites.

FAQ

Do virtual prepaid cards work for every online store?

They work for most websites that accept Visa or Mastercard, but some merchants use strict verification rules that may block prepaid cards. This includes certain travel bookings and high-risk platforms. Using correct billing information improves success rates.

Can I use a virtual prepaid card for recurring monthly subscriptions?

Yes. It works well for monthly renewals as long as you keep enough balance. If the balance becomes low during billing, the transaction will fail. Keeping a small buffer prevents this.

How do refunds work on a virtual prepaid card?

Refunds return to the same card balance. The processing time depends on the merchant. Some issue refunds instantly, while others may take a few business days. You can track refund updates inside your CardUpNow dashboard.

Can I add my virtual prepaid card to Apple Pay or Google Pay?

Some providers support mobile wallet integration, but not all. This depends on the card issuer. CardUpNow updates these features regularly, so users should check inside their account for current availability.

Is a virtual prepaid card safer than using my bank card online?

Yes. Since it does not connect to your bank account, the risk is limited to your prepaid balance. It reduces exposure during online shopping, international purchases, and payments on new or high-risk websites.

At Closing

A virtual prepaid card gives you a simple and secure way to pay online without exposing your main financial details. It helps avoid unnecessary declines, offers better control over spending, and works across a wide range of international platforms.

If you want a reliable, reloadable Visa prepaid virtual card that you can manage easily, CardUpNow is a strong choice.